eBay 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

compensation arrangements that were not approved by our stockholders, also referred to as our Non-Plan

Grants. No warrants are outstanding under any of the foregoing plans.

(c)

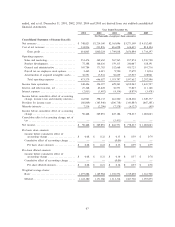

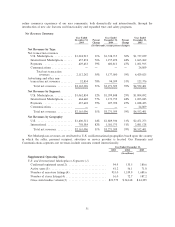

Number of Securities

(a) Remaining Available for

Number of Securities (b) Future Issuance Under

to be Issued Upon Weighted Average Equity Compensation

Exercise of Exercise Price of Plans (Excluding

Outstanding Options, Outstanding Options, Securities Reflected in

Plan Category Warrants and Rights Warrants and Rights Column (a))

Equity compensation plans approved

by securityholdersÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 123,622,549(1) $28.97(2) 103,280,368(3)

Equity compensation plans not

approved by securityholders ÏÏÏÏÏÏ 1,382,728(4)(5)(6) 0.39 Ì

(7)(8)(9)

Total ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 125,005,277 $28.65 103,280,368

(1) Includes 27,391 shares of our common stock issuable pursuant to deferred stock units, or DSUs, under

our 2003 Deferred Stock Unit Plan. DSUs represent an unfunded, unsecured right to receive shares of

eBay common stock (or the equivalent value thereof in cash or property), and the value of DSUs varies

directly with the price of eBay's common stock.

(2) Because DSUs do not have an exercise price, the 27,391 shares of our common stock issuable pursuant to

DSUs under our 2003 Deferred Stock Unit Plan are not included in the calculation of weighted average

exercise price.

(3) Includes 5,788,596 shares of our common stock remaining reserved for future issuance under our 1998

Employee Stock Purchase Plan, as amended, or the ESPP, as of December 31, 2005. Our ESPP contains

an ""evergreen'' provision that automatically increases, on each January 1, the number of securities

reserved for issuance under the ESPP by the number of shares purchased under the ESPP in the

preceding calendar year, provided that the aggregate number of shares reserved for issuance under the

ESPP may not exceed 36,000,000 shares. As of December 31, 2005, an aggregate amount of 8,160,996

shares had been purchased under the ESPP since its inception. An aggregate amount of 1,411,404 shares

was purchased under the ESPP in 2005, and the number of securities available for issuance under the

ESPP was increased by that number on January 1, 2006, bringing the total number of shares reserved for

future issuance on January 1, 2006 to 7,200,000. None of our other plans has an ""evergreen'' provision.

(4) Does not include 12,262 shares of our common stock, with a weighted average exercise price of $2.38 per

share, to be issued upon exercise of outstanding options assumed by us under the Half.com, Inc. 1999

Equity Compensation Plan, or the Half.com Plan, in connection with our acquisition of Half.com in 2000,

as we cannot make subsequent grants or awards of our equity securities under the Half.com Plan. Prior to

our acquisition of Half.com, the stockholders of Half.com approved the Half.com Plan. Our stockholders,

however, did not approve the Half.com Plan in connection with our acquisition of Half.com.

(5) Does not include 60,572 shares of our common stock, with a weighted average exercise price of $0.77 per

share, to be issued upon exercise of outstanding options assumed by us under the X.com Corporation

1999 Stock Plan, or the X.com Plan, in connection with our acquisition of PayPal in October 2002, as we

cannot make subsequent grants or awards of our equity securities under the X.com Plan. Prior to our

acquisition of PayPal, the stockholders of PayPal approved the X.com Plan. Our stockholders, however,

did not approve the X.com Plan in connection with our acquisition of PayPal.

(6) Does not include 637,142 shares of our common stock, with a weighted average exercise price of

$9.19 per share, to be issued upon exercise of outstanding options assumed by us under the PayPal, Inc.

2001 Equity Incentive Plan, or the PayPal Plan, in connection with our acquisition of PayPal in October

2002, as we cannot make subsequent grants or awards of our equity securities under the PayPal Plan.

Prior to our acquisition of PayPal, the stockholders of PayPal approved the PayPal Plan. Our

stockholders, however, did not approve the PayPal Plan in connection with our acquisition of PayPal.

45