eBay 2005 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

Investments accounted for under the equity method of accounting are classified on our balance sheet as

long-term investments. Such investments include identifiable intangible assets, deferred tax liabilities and

goodwill. Goodwill related to our equity method investments totaled approximately $27.4 million as of

December 31, 2004 and 2005.

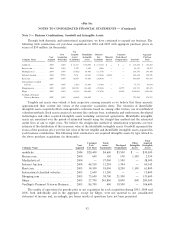

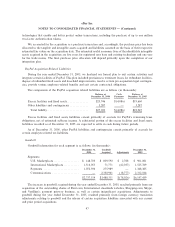

Intangible Assets

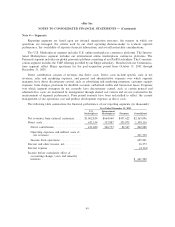

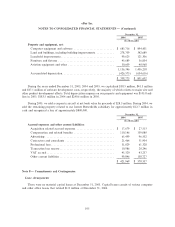

The components of acquired identifiable intangible assets are as follows (in thousands):

December 31, 2004 December 31, 2005

Gross Net Weighted Gross Net Weighted

Carrying Accumulated Carrying Average Useful Carrying Accumulated Carrying Average Useful

Amount Amortization Amount Economic Life Amount Amortization Amount Economic Life

(years) (years)

Intangible assets:

Customer lists

and user base $300,929 $ (80,097) $220,832 7 $ 526,657 $(145,397) $381,260 6

Trademarks and

trade names ÏÏ 139,239 (30,811) 108,428 6 443,565 (75,571) 367,994 5

Developed

technologies ÏÏ 40,686 (28,488) 12,198 3 101,971 (45,882) 56,089 4

All other ÏÏÏÏÏÏÏ 33,895 (7,534) 26,361 4 36,450 (14,761) 21,689 4

$514,749 $(146,930) $367,819 $1,108,643 $(281,611) $827,032

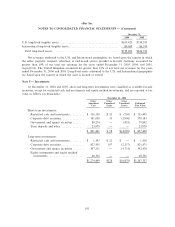

All of our acquired identifiable intangible assets are subject to amortization. Acquired identifiable

intangible assets are comprised of customer lists and user base, trademarks and trade names, developed

technologies, and other acquired intangible assets including patents and contractual agreements. No signifi-

cant residual value is estimated for the intangible assets. The increase in intangible assets during the year

ended December 31, 2005 resulted primarily from certain intangible assets acquired as part of our acquisition

of the outstanding shares of Rent.com, International classifieds websites, Shopping.com, Skype and VeriSign's

payment gateway business totaling approximately $61.8 million, $13.8 million, $133.6 million, $280.3 million,

and $106.6 million, respectively. The net carrying amount of intangible assets related to our investments

totaled approximately $4.9 million and $3.8 million, as of December 31, 2004 and 2005, respectively.

Aggregate amortization expense for intangible assets totaled $53.2 million, $70.2 million and $136.4 million

for the years ended December 31, 2003, 2004 and 2005, respectively.

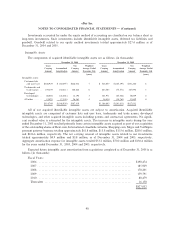

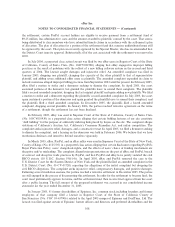

Expected future intangible asset amortization from acquisitions completed as of December 31, 2005 is as

follows (in thousands):

Fiscal Years:

2006 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $198,474

2007 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 185,929

2008 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 178,201

2009 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 159,791

2010 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 88,479

Thereafter ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 16,158

$827,032

98