eBay 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

that increase the effective tax rate, offset by decreases resulting from foreign income with lower effective tax

rates and tax credits.

The lower effective tax rates in 2005 and 2004 as compared to 2003 reflect the increasing profit

contribution from our international operations that are subject to lower tax rates.

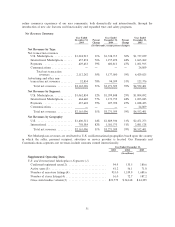

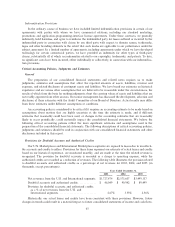

Minority Interests

Percent Percent

2003 Change 2004 Change 2005

(In thousands, except percentages)

Minority interests ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $(7,578) 19% $(6,122) (99)% $(49)

As a percentage of net revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 0.4% 0.2% 0.0%

Minority interests represents the minority investors' percentage share of income or losses from subsidiar-

ies in which we hold a majority ownership interest and consolidate the subsidiaries' results in our financial

statements. Third parties held minority interests in various of our subsidiaries during 2003, 2004 and 2005.

The changes in minority interests in 2004 and 2005 were due primarily to our acquisition of a 38%

additional ownership interest in Internet Auction during 2004, which brought our ownership to over 99%.

Cumulative Effect of Change in Accounting Principle

In accordance with the provisions of FIN 46, ""Consolidation of Variable Interest Entities,'' we included

our San Jose headquarters lease arrangement in our consolidated financial statements effective July 1, 2003.

Our consolidated statement of income for the year ended December 31, 2003 reflected the reclassification of

lease payments on our San Jose headquarters from operating expense to interest expense, beginning with the

quarters following our adoption of FIN 46 on July 1, 2003, a $5.4 million after-tax charge for cumulative

depreciation for periods from lease inception through June 30, 2003, and incremental depreciation expense of

approximately $400,000, net of tax, per quarter for periods after June 30, 2003. We adopted the provisions of

FIN 46 prospectively from July 1, 2003, and as a result, did not restate prior periods. The cumulative effect of

the change in accounting principle arising from the adoption of FIN 46 was reflected in net income in 2003.

As of December 31, 2004, we had $126.4 million included within current restricted cash and investments

relating to our San Jose headquarters lease facility lease arrangement, which had effectively provided us with

full ownership rights to these facilities. In February 2004, we elected not to extend the lease period, which

required us to purchase the facility on March 1, 2005. We utilized the $126.4 million related restricted cash

and investments to complete the purchase of the facility.

Impact of Foreign Currency Translation

During 2005, our international net revenues, based upon the country in which the seller, payment

recipient, advertiser or other service provider is located, accounted for approximately 46% of our consolidated

net revenues, as compared to 42% of our net revenues in 2004 and 35% of our net revenues in 2003. The

growth in our international operations has increased our exposure to foreign currency fluctuations. Net

revenues and related expenses generated from international locations are denominated in the functional

currencies of the local countries, and include Euros, British pounds, Korean won, Canadian dollars, Taiwanese

dollars, Australian dollars, Chinese renminbi, and Indian rupee. The results of operations and certain of our

inter-company balances associated with our international locations are exposed to foreign exchange rate

fluctuations. The statements of income of our international operations are translated into U.S. dollars at the

average exchange rates in each applicable period. To the extent the U.S. dollar weakens against foreign

currencies, the translation of these foreign currency denominated transactions results in increased consolidated

net revenues, operating expenses and net income.

During 2005, the U.S. dollar weakened against most of the foreign currencies listed above. Using the

weighted-average foreign currency exchange rates from 2004, our net revenues for 2005 would have been

lower than reported using the actual exchange rates for 2005 by approximately $12.0 million. In addition, if

60