eBay 2005 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

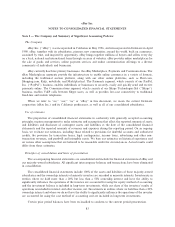

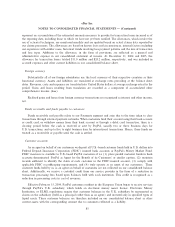

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

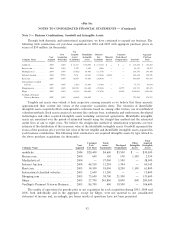

Property and equipment

Property and equipment are stated at historical cost less accumulated depreciation. Depreciation and

amortization are computed using the straight-line method over the estimated useful lives of the assets,

generally, one to three years for computer equipment and software, up to 30 years for buildings and building

improvements, ten years for aviation equipment, the shorter of five years or the term of the lease for leasehold

improvements, three years for furniture and fixtures and three years for vehicles.

Goodwill and intangible assets

Goodwill represents the excess of the purchase price over the fair value of the net tangible and

identifiable intangible assets acquired in a business combination. Intangible assets resulting from the

acquisitions of entities accounted for using the purchase method of accounting are estimated by management

based on the fair value of assets received. Identifiable intangible assets are comprised of purchased customer

lists and user base, trademarks and trade names, developed technologies, and other intangible assets.

Identifiable intangible assets are being amortized over the period of estimated benefit using the straight-line

method and estimated useful lives ranging from one to eight years. Goodwill is not subject to amortization, but

is subject to at least an annual assessment for impairment, applying a fair-value based test.

Impairment of Long-lived assets

We evaluate long-lived assets for impairment whenever events or changes in circumstances indicate that

the carrying amount of a long-lived asset may not be recoverable. An asset is considered impaired if its

carrying amount exceeds the future net cash flow the asset is expected to generate. If an asset is considered to

be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the

asset exceeds its fair market value. We assess the recoverability of our long-lived and intangible assets by

determining whether the unamortized balances can be recovered through undiscounted future net cash flows

of the related assets. The amount of impairment, if any, is measured based on projected discounted future net

cash flows.

We evaluate goodwill, at a minimum, on an annual basis and whenever events and changes in

circumstances suggest that the carrying amount may not be recoverable. Impairment of goodwill is tested at

the reporting unit level by comparing the reporting unit's carrying amount, including goodwill, to the fair value

of the reporting unit. The fair values of the reporting units are estimated using a combination of the income, or

discounted cash flows, approach and the market approach, which utilizes comparable companies' data. If the

carrying amount of the reporting unit exceeds its fair value, goodwill is considered impaired and a second step

is performed to measure the amount of impairment loss, if any. We conducted our annual impairment test as

of August 31, 2005 and determined there was no impairment. There were no events or circumstances from

that date through December 31, 2005 that would impact this assessment.

Revenue recognition

Our net revenues result from fees associated with our transaction, advertising and other non-transaction

services in our U.S. Marketplaces, International Marketplaces, Payments and Communications segments.

Transaction revenue is derived primarily from listing, feature and final value fees paid by sellers and fees from

payment processing services. Revenue from advertising is derived principally from the sale of online banner

and sponsorship advertisements for cash and through barter arrangements. Other non-transaction net revenue

is primarily composed of our end-to-end services net revenue that is derived principally from contractual

arrangements with third parties that provide transaction services to eBay users. Revenue is recognized when

evidence of an arrangement exists, the fee is fixed and determinable, no significant obligation remains and

collection of the receivable is reasonably assured.

86