eBay 2005 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

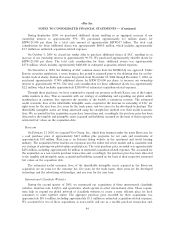

Advertising expense

We expense the costs of producing advertisements at the time production occurs and expense the cost of

communicating advertising in the period during which the advertising space or airtime is used. Internet

advertising expenses are recognized based on the terms of the individual agreements, which is generally over

the greater of the ratio of the number of impressions delivered over the total number of contracted

impressions, pay-per-click, or on a straight-line basis over the term of the contract. Advertising expenses

totaled $321.4 million, $459.5 million and $665.1 million during the years ended December 31, 2003, 2004,

and 2005, respectively.

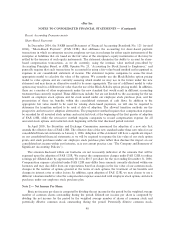

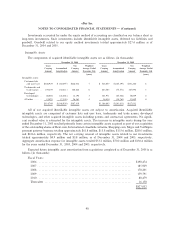

Stock-based compensation

We account for stock-based employee compensation issued under compensatory plans using the intrinsic

value method, which calculates compensation expense based on the difference, if any, on the date of the grant,

between the fair value of our stock and the option exercise price. Generally accepted accounting principles

require companies who choose to account for stock option grants using the intrinsic value method to also

determine the fair value of option grants using an option pricing model, such as the Black-Scholes model, and

to disclose the impact of fair value accounting in a note to the financial statements. In December 2002, the

FASB issued Statement of Financial Accounting Standards No. 148, ""Accounting for Stock-Based Compen-

sation Transition and Disclosure, an Amendment of FASB Statement No. 123.'' We did not elect to

voluntarily change to the fair value based method of accounting for stock based employee compensation and

record such amounts as charges to operating expense. We amortize the stock-based compensation charge in

accordance with FASB Interpretation No. 28 over the vesting period of the related options, which is generally

four years. The impact of recognizing the fair value of option grants and stock grants under our employee stock

purchase plan as an expense under FASB Statement No. 148 would have substantially reduced our net

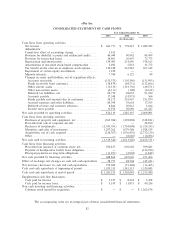

income, as follows (in thousands, except per share amounts):

Year Ended December 31,

2003 2004 2005

Net income, as reported ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $441,771 $778,223 $1,082,043

Add: Amortization of stock-based compensation expense

determined under the intrinsic value method, net of taxÏÏ 5,492 1,715 18,749

Deduct: Total stock-based compensation expense

determined under fair value based method, net of tax ÏÏÏ (201,775) (190,935) (248,260)

Pro forma net income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $245,488 $589,003 $ 852,532

Earnings per share:

Basic Ì ReportedÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.35 $ 0.59 $ 0.79

Pro forma ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.19 $ 0.45 $ 0.63

Diluted Ì ReportedÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.34 $ 0.57 $ 0.78

Pro forma ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.19 $ 0.43 $ 0.61

The weighted average fair value of options granted in the years ended December 31, 2003, 2004 and 2005,

were $8.15, $12.12 and $11.70, respectively.

88