eBay 2005 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

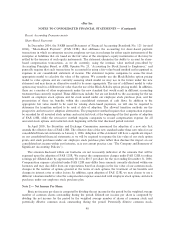

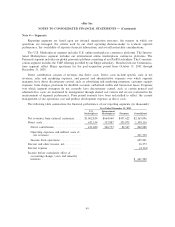

We calculated the fair value of each option award on the date of grant using the Black-Scholes option

pricing model. The following weighted average assumptions were used for each respective period:

Year Ended December 31,

2003 2004 2005

Risk-free interest ratesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1.9% 2.5% 3.8%

Expected livesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 3 years 3 years 3 years

Dividend yieldÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 0% 0% 0%

Expected volatility ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 64% 49% 36%

We account for stock-based arrangements issued to non-employees using the fair value based method,

which calculates compensation expense based on the fair value of the stock option granted using the Black-

Scholes option pricing model at the date of grant, or over the period of performance, as appropriate.

Income taxes

We account for income taxes using an asset and liability approach, which requires the recognition of taxes

payable or refundable for the current year and deferred tax liabilities and assets for the future tax

consequences of events that have been recognized in our financial statements or tax returns. The measurement

of current and deferred tax assets and liabilities is based on provisions of enacted tax laws; the effects of future

changes in tax laws or rates are not anticipated. If necessary, the measurement of deferred tax assets is

reduced by the amount of any tax benefits that are not expected to be realized based on available evidence.

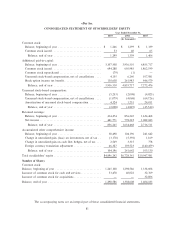

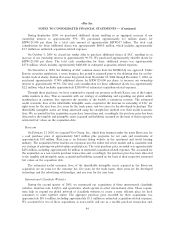

Cumulative Effect of Change in Accounting Principle

In accordance with the provisions of FIN 46, ""Consolidation of Variable Interest Entities,'' we have

included our San Jose corporate headquarters lease arrangement in our consolidated financial statements since

July 1, 2003. Under this accounting standard, our balance sheet at December 31, 2004 reflects additions for

land and buildings totaling $126.4 million, lease obligations of $122.5 million and non-controlling minority

interests of $3.9 million. Our consolidated statement of income for the year ended December 31, 2003, reflects

the reclassification of lease payments on our San Jose corporate headquarters from operating expense to

interest expense, beginning with quarters following our adoption of FIN 46 on July 1, 2003, a $5.4 million

after-tax charge for cumulative depreciation for periods from lease inception through June 30, 2003, and

incremental depreciation expense of approximately $400,000, net of tax, per quarter for periods after June 30,

2003. We have adopted the provisions of FIN 46 prospectively from July 1, 2003, and as a result, have not

restated prior periods. The cumulative effect of the change in accounting principle arising from the adoption of

FIN 46 has been reflected in net income in 2003. As of December 31, 2004, we had $126.4 million included

within current restricted cash and investments relating to our San Jose headquarters lease facility lease

arrangement, which had effectively provided us with full ownership rights to these facilities. In February 2004,

we elected not to extend the lease period, which required us to purchase the facility on March 1, 2005. We

utilized the $126.4 million in restricted cash and investments to complete the purchase of the facility.

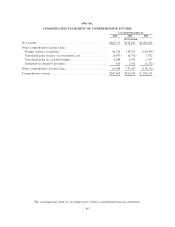

Comprehensive income

Comprehensive income includes all changes in equity (net assets) during a period from non-owner

sources. The change in accumulated other comprehensive income for all periods presented resulted from, net

of tax foreign currency translation gains and losses, unrealized and realized gains and losses on investments,

and unrealized gains and losses on cash flow hedges.

89