eBay 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

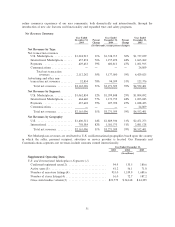

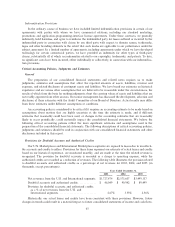

Payroll Tax on Employee Stock Options

Percent Percent

2003 Change 2004 Change 2005

(In thousands, except percentages)

Payroll tax on employee stock options ÏÏÏÏÏÏÏÏ $9,590 82% $17,479 (26)% $13,014

As a percentage of net revenuesÏÏÏÏÏÏÏÏÏÏÏÏÏ 0.4% 0.5% 0.3%

We are subject to employer payroll taxes on employee gains from the exercise of non-qualified stock

options. These employer payroll taxes are recorded as a charge to operations in the period in which such

options are exercised and sold based on actual gains realized by employees. The fluctuation in each respective

year was primarily the result of the extent of employee gains recognized on stock option exercises. Our results

of operations and cash flows could vary significantly depending on the actual period that stock options are

exercised by employees and, consequently, the amount of employer payroll taxes assessed. In general, we

expect payroll taxes on employee stock option gains to increase during periods in which our stock price is high

relative to historic levels.

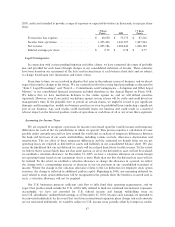

Amortization of Acquired Intangible Assets

Percent Percent

2003 Change 2004 Change 2005

(In thousands, except percentages)

Amortization of acquired intangible assets ÏÏ $50,659 30% $65,927 96% $128,941

As a percentage of net revenuesÏÏÏÏÏÏÏÏÏÏÏ 2.3% 2.0% 2.8%

From time to time we have purchased, and we expect to continue purchasing, assets or businesses to

accelerate category and geographic expansion increase the features, functions, and formats available to our

users and maintain a leading role in online e-commerce. These purchase transactions generally result in the

creation of acquired intangible assets and lead to a corresponding increase in the amortization expense in

future periods. The increase in amortization of acquired intangibles during 2005 compared to prior years is due

to the business acquisitions consummated during 2004 and 2005.

Intangible assets include purchased customer lists and user base, trademarks and trade names, developed

technologies, and other intangible assets. We amortize intangible assets, excluding goodwill, over the period of

estimated benefit, using the straight-line method and estimated useful lives ranging from one to eight years.

Goodwill represents the excess of the purchase price over the fair value of the net tangible and

identifiable intangible assets acquired in a business combination. We evaluate goodwill, at a minimum, on an

annual basis and whenever events and changes in circumstances suggest that the carrying amount may not be

recoverable. Impairment of goodwill is tested at the reporting unit level by comparing the reporting unit's

carrying amount, including goodwill, to the fair value of the reporting unit. The fair values of the reporting

units are estimated using a combination of the income, or discounted cash flows, approach and the market

approach, which utilizes comparable companies' data. If the carrying amount of the reporting unit exceeds its

fair value, goodwill is considered impaired and a second step is performed to measure the amount of

impairment loss, if any. Our annual impairment test was carried out as of August 31, 2005 and we determined

that there was no impairment. There were no events or circumstances from that date through December 31,

2005 that would impact this assessment.

We expect amortization of acquired intangible assets to increase in 2006 as a result of the intangible

assets associated with our 2005 acquisitions. Amortization of acquired intangible assets may increase should

we make additional acquisitions in the future.

58