eBay 2005 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

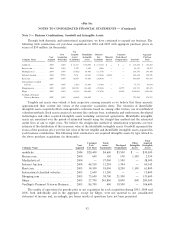

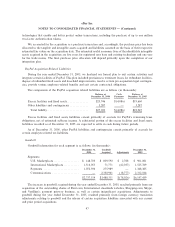

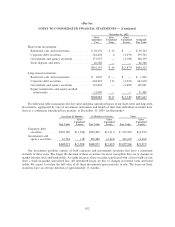

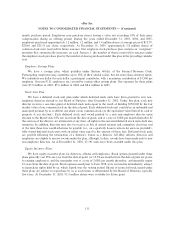

December 31, 2005

Gross Gross Gross

Amortized Unrealized Unrealized Estimated

Cost Gains Losses Fair Value

Short-term investments:

Restricted cash and investmentsÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 29,670 $ 32 $ Ì $ 29,702

Corporate debt securitiesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 362,438 4 (2,679) 359,763

Government and agency securities ÏÏÏÏÏÏÏÏÏÏÏ 371,537 Ì (3,198) 368,339

Time deposits and other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 46,548 Ì Ì 46,548

$810,193 $ 36 $(5,877) $804,352

Long-term investments:

Restricted cash and investmentsÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 1,065 $ Ì $ Ì $ 1,065

Corporate debt securitiesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 665,418 115 (1,921) 663,612

Government and agency securities ÏÏÏÏÏÏÏÏÏÏÏ 110,450 Ì (1,409) 109,041

Equity instruments and equity method

investments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 51,949 Ì Ì 51,949

$828,882 $115 $(3,330) $825,667

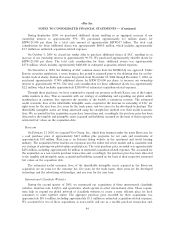

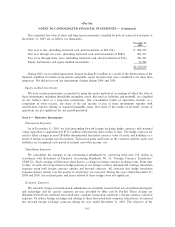

The following table summarizes the fair value and gross unrealized losses of our short-term and long-term

investments, aggregated by type of investment instrument and length of time that individual securities have

been in a continuous unrealized loss position, at December 31, 2005 (in thousands):

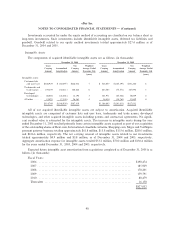

Less than 12 Months 12 Months or Greater Total

Gross Gross Gross

Unrealized Unrealized Unrealized

Fair Value Losses Fair Value Losses Fair Value Losses

Corporate debt

securitiesÏÏÏÏÏÏÏÏÏÏ $401,789 $(1,544) $250,487 $(3,011) $ 652,276 $(4,555)

Government and

agency securities ÏÏÏ 47,184 (38) 398,486 (4,624) 445,670 (4,662)

$448,973 $(1,582) $648,973 $(7,635) $1,097,946 $(9,217)

Our investment portfolio consists of both corporate and government securities that have a maximum

maturity of three years. The longer the duration of these securities, the more susceptible they are to changes in

market interest rates and bond yields. As yields increase, those securities purchased with a lower yield-at-cost

show a mark-to-market unrealized loss. All unrealized losses are due to changes in interest rates and bond

yields. We expect to realize the full value of all these investments upon maturity or sale. The losses on these

securities have an average duration of approximately 11 months.

102