eBay 2005 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

company that resulted from the merger, Shopping.com Ltd. eBay completed its acquisition of Shopping.com

Ltd. on August 30, 2005. The lawsuit contended that the defendants were responsible for breaches of fiduciary

duty and material misstatements and omissions, that defendants undervalued the DealTime stock that

Epinions' shareholders received in connection with the merger, and that plaintiffs' common stock of Epinions

was wrongfully cancelled without compensation. Defendants disputed the contentions of the case and denied

any allegations of wrongdoing. The parties tentatively reached agreement as to the monetary terms for

settlement of the dispute in September 2005, and in December 2005, the settlement was finalized and the

lawsuit was dismissed. The settlement amount has been accounted for as an assumed liability in connection

with our acquisition of Shopping.com.

Other third parties have from time to time claimed, and others may claim in the future, that we have

infringed their intellectual property rights. We have been notified of several potential patent disputes, and

expect that we will increasingly be subject to patent infringement claims as our services expand in scope and

complexity. In particular, we expect to face additional patent infringement claims involving services we

provide, including various aspects of our Payments and communications businesses. We have in the past been

forced to litigate such claims. We may also become more vulnerable to third-party claims as laws such as the

Digital Millennium Copyright Act, the Lanham Act and the Communications Decency Act are interpreted by

the courts and as we expand geographically into jurisdictions where the underlying laws with respect to the

potential liability of online intermediaries like ourselves are either unclear or less favorable. These claims,

whether meritorious or not, could be time consuming and costly to resolve, cause service upgrade delays,

require expensive changes in our methods of doing business, or could require us to enter into costly royalty or

licensing agreements.

From time to time, we are involved in other disputes or regulatory inquiries that arise in the ordinary

course of business. The number and significance of these disputes and inquiries are increasing as our business

expands and our company grows larger. Any claims or regulatory actions against us, whether meritorious or

not, could be time consuming, result in costly litigation, require significant amounts of management time, and

result in the diversion of significant operational resources.

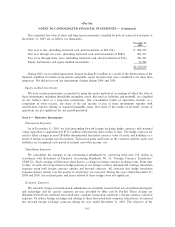

Indemnification Provisions

In the ordinary course of business, we have included limited indemnification provisions in certain of our

agreements with parties with whom we have commercial relations, including our standard marketing,

promotions and application-programming-interface license agreements. Under these contracts, we generally

indemnify, hold harmless, and agree to reimburse the indemnified party for losses suffered or incurred by the

indemnified party in connection with claims by any third party with respect to our domain names, trademarks,

logos and other branding elements to the extent that such marks are applicable to our performance under the

subject agreement. In a limited number of agreements, including agreements under which we have developed

technology for certain commercial parties, we have provided an indemnity for other types of third-party

claims, substantially all of which are indemnities related to our copyrights, trademarks, and patents. In our

PayPal business, we have provided an indemnity to our payments processors in the event of certain third-party

claims or card association fines against the processor arising out of conduct by PayPal. To date, no significant

costs have been incurred, either individually or collectively, in connection with our indemnification provisions.

Note 9 Ì Related Party Transactions:

We have entered into indemnification agreements with each of our directors, executive officers and

certain other officers. These agreements require us to indemnify such individuals, to the fullest extent

permitted by Delaware law, for certain liabilities to which they may become subject as a result of their

affiliation with us.

109