eBay 2005 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

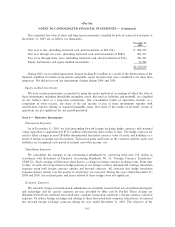

A member of our Board of Directors is a general partner of certain venture capital funds that beneficially

hold in the aggregate a greater than 10% equity interest in several public and private companies. In 2000, we

invested $3.0 million in capital stock of one such private company that provides a real estate solution to home

buyers and sellers and received a warrant to purchase additional shares, which if exercised, would bring our

total ownership to less than 5% of its capital stock. The member of our Board of Directors referred to above is

also a member of such company's Board of Directors. Such company effected an initial public offering of its

common stock in 2004 and we sold all of the shares we owned in such company in 2005.

Separately, a member of our Board of Directors is a director and Chairman of the Executive Committee

of the Board of Directors of a company with whom PayPal, in September 2000, prior to eBay's acquisition of

PayPal, entered into a strategic marketing agreement. The agreement was terminated in December 2002, and

PayPal paid the company an early termination fee of $1.3 million in January 2003 in accordance with the

terms of the agreement. In addition, in July 2003, such company purchased an entity with which eBay had a

pre-existing data licensing agreement. In June 2004, this contract was amended to extend the term of the

agreement and to update the fees. Under the terms of eBay's agreement, as amended, with the purchased

entity, eBay recognized $156,000 of revenue in 2003, $323,000 of revenue in 2004, and $143,000 of revenue in

2005. The revenues expected to be recognized by us is approximately $35,500 per quarter for the remainder of

the term, which is through May 2006.

As of December 31, 2005, there were no significant amounts payable or amounts receivable under these

arrangements. All contracts with related parties are at rates and terms that we believe are comparable with

those entered into with independent third parties.

Note 10 Ì Preferred Stock:

We are authorized, subject to limitations prescribed by Delaware law: to issue Preferred Stock in one or

more series; to establish the number of shares included within each series; to fix the rights, preferences and

privileges of the shares of each wholly unissued series and any related qualifications, limitations or restrictions;

and to increase or decrease the number of shares of any series (but not below the number of shares of a series

then outstanding) without any further vote or action by the stockholders. At December 31, 2004 and 2005,

there were 10 million shares of $0.001 par value Preferred Stock authorized for issuance, and no shares issued

or outstanding.

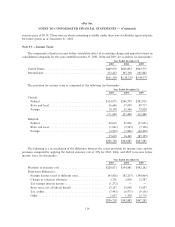

Note 11 Ì Common Stock:

Our Certificate of Incorporation, as amended, authorizes us to issue 3,580 million shares of common

stock. A portion of the shares outstanding are subject to repurchase over a four-year period from the earlier of

the issuance date or employee hire date, as applicable. At December 31, 2004 and 2005 there were 140,000

and 40,000 shares subject to repurchase rights, respectively.

At December 31, 2005, we had reserved 222.6 million shares of common stock available for future

issuance under our stock option plans, including 129.1 million shares related to outstanding stock options. In

addition, as of December 31, 2005, we had reserved approximately 4.0 million shares of common stock

available for future issuance under our deferred stock unit plan, and approximately 5.8 million shares of

common stock available for future issuance under our employee stock purchase plan.

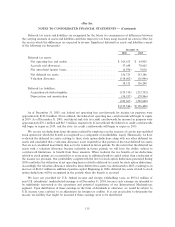

Note 12 Ì Employee Benefit Plans:

Employee Stock Purchase Plan

We have an employee stock purchase plan for all eligible employees. Under the plan, shares of our

common stock may be purchased over an offering period with a maximum duration of two years at 85% of the

lower of the fair market value on the first day of the applicable offering period or on the last day of the six-

110