eBay 2005 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

Fair value of financial instruments

Cash and cash equivalents are short-term, highly liquid investments with original or remaining maturities

of three months or less when purchased. Our financial instruments, including cash, cash equivalents, accounts

receivable, funds receivable, accounts payable, and funds payable are carried at cost, which approximates their

fair value because of the short-term maturity of these instruments.

Short and long-term investments, which include marketable equity securities and government and

corporate bonds, are classified as available-for-sale and reported at fair value using the specific identification

method. Unrealized gains and losses are excluded from earnings and reported as a component of other

comprehensive income (loss), net of related estimated tax provisions or benefits. Additionally, we assess

whether an other-than-temporary impairment loss on our investments has occurred due to declines in fair

value or other market conditions. Declines in fair value that are considered other than temporary are recorded

as an impairment of certain equity investments in the consolidated statement of income.

Derivative instruments

We recognize all derivative instruments on the balance sheet at fair value. Changes in the fair value (i.e.,

gains or losses) of the derivatives are recorded each period in the consolidated statement of income or

accumulated other comprehensive income (loss). For a derivative designated as a cash flow hedge, the gain or

loss on the derivative is initially reported as a component of accumulated other comprehensive income (loss)

and subsequently reclassified into the consolidated statement of income when the hedged transaction affects

earnings. For derivatives recognized as a fair value hedge, the gain or loss on the derivative in the period of

change and the offsetting loss or gain of the hedged item attributed to the hedged risk, are recognized in

accumulated other comprehensive income until the hedge matures, at which time the gain or loss is

recognized as interest and other income, net. For derivatives not recognized as hedges, the gain or loss on the

derivative in the period of changes is recognized as interest and other income, net.

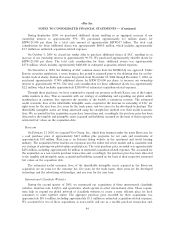

Concentrations of credit risk

Our cash, cash equivalents, accounts receivable and funds receivable are potentially subject to concentra-

tion of credit risk. Cash and cash equivalents are placed with financial institutions that management believes

are of high credit quality. Our accounts receivable are derived from revenue earned from customers located in

the U.S. and internationally. Accounts receivable balances are settled through customer credit cards, debit

cards, and PayPal accounts, with the majority of accounts receivable collected upon processing of credit card

transactions. We maintain an allowance for doubtful accounts receivable and authorized credits based upon

our historical experience. Historically, such losses have been within our expectations. However, unexpected or

significant future changes in trends could result in a material impact to future statements of income or cash

flows. Due to the relatively small dollar amount of individual accounts receivable, we generally do not require

collateral on these balances. The provision for doubtful accounts is recorded as a charge to operating expense,

while the provision for authorized credits is recognized as a reduction of net revenues.

During the years ended December 31, 2003, 2004, and 2005, no customers accounted for more than 10%

of net revenues. As of December 31, 2004 and 2005, no customers accounted for more than 10% of net

accounts receivable.

Allowances for transaction losses

Our Payments segment is exposed to transaction losses due to fraud, as well as non-performance of

customers. We establish allowances for estimated losses arising from processing customer transactions, such as

charge-backs for unauthorized credit card use and merchant related charge-backs due to non-delivery of goods

or services, Automated Clearing House, or ACH, returns, and debit card overdrafts. These allowances

84