eBay 2005 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

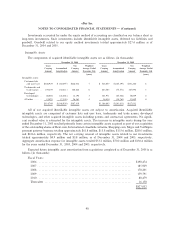

forward contracts is to better ensure that the U.S. dollar-equivalent cash flows are not adversely affected by

changes in the U.S. dollar/Euro exchange rate. Pursuant to Statement of Financial Accounting Standards

No. 133 ""Accounting for Derivative Instruments and Hedging Activities'' (FAS 133), we expect the hedge of

certain of these forecasted transactions to be highly effective in offsetting potential changes in cash flows

attributed to a change in the U.S. dollar/Euro exchange rate. Accordingly, we record as a component of

accumulated other comprehensive income all unrealized gains and losses related to the forward contracts that

receive hedge accounting treatment. We record all unrealized gains and losses in interest and other income,

net, related to the forward contracts that do not receive hedge accounting treatment pursuant to FAS 133.

During the years ended December 31, 2004 and 2005, the realized gains and losses related to these hedges

were not significant. The notional amount of our economic hedges receiving hedge accounting treatment and

the losses, net of gains, recorded to accumulated other comprehensive income as of December 31, 2004 was

$140.2 million and $3.4 million, respectively. The notional amount of our economic hedges receiving hedge

accounting treatment and the losses, net of gains, recorded to accumulated other comprehensive income as of

December 31, 2005 was $203.0 million and $200,000, respectively.

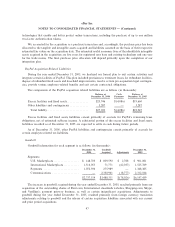

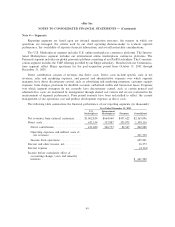

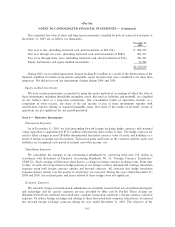

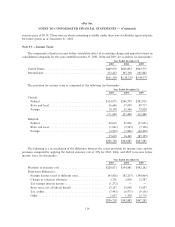

Note 7 Ì Balance Sheet Components:

December 31,

2004 2005

(In thousands)

Accounts receivable, net:

Accounts receivable ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $319,489 $396,373

Allowance for doubtful accounts ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (67,853) (62,507)

Allowance for authorized credits ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (10,780) (11,078)

$240,856 $322,788

December 31,

2004 2005

(In thousands)

Other current assets:

Customer accountsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $270,918 $324,595

Prepaid expenses ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 54,159 44,610

Deferred tax asset, netÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 10,427 59,274

Other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 43,911 58,756

$379,415 $487,235

104