eBay 2005 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

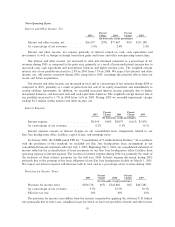

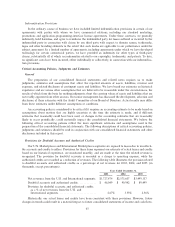

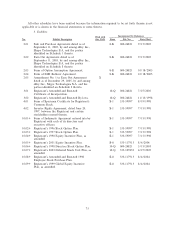

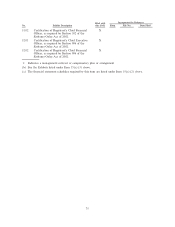

The following table illustrates the effective tax rates for 2003, 2004, and 2005 (in thousands, except

percentages):

Years Ended December 31,

2003 2004 2005

Provision for income taxes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $206,738 $343,885 $467,285

As a % of income before income taxes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 32% 30% 30%

Historically, these provisions have adequately provided for our actual income tax liabilities. Our future

effective tax rates could be adversely affected by earnings being lower than anticipated in countries where we

have lower statutory rates and higher than anticipated in countries where we have higher statutory rates, by

changes in the valuations of our deferred tax assets or liabilities, or by changes or interpretations in tax laws,

regulations or accounting principles.

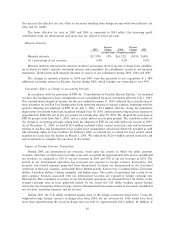

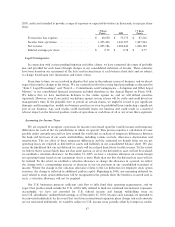

Based on our results for the year ended December 31, 2005, a one-percentage point change in our

provision for income taxes as a percentage of income before taxes would have resulted in an increase or

decrease in the provision of approximately $15.5 million. The following analysis demonstrates, for illustrative

purposes only, the potential effect such a one-percentage point deviation change would have upon our

consolidated financial statements and is not intended to provide a range of exposure or expected deviation (in

thousands, except per share data):

¿100 Basis °100 Basis

Points 2005 Points

Provision for income taxes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 451,791 $ 467,285 $ 482,779

Income from operations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,441,707 1,441,707 1,441.707

Net incomeÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,097,537 1,082,043 1,066,549

Diluted earnings per share ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.79 $ 0.78 $ 0.77

Advertising and Other Non-Transaction Revenues

A portion of our net revenues result from fees associated with advertising and other non-transaction

services in our U.S. Marketplaces, International Marketplaces and Payments segments. Net revenues from

advertising are derived principally from the sale of online banner and sponsorship advertisements for cash and

through barter arrangements. Other non-transaction net revenues are derived principally from contractual

arrangements with third parties that provide transaction services to eBay users and from offline services

provided by wholly-owned subsidiaries that were divested in the second half of 2002. Advertising and other

non-transaction net revenues, including barter transactions, totaled 2%, 3% and 3% of our consolidated net

revenues for the years ended December 31, 2003, 2004 and 2005, respectively, and were primarily generated

by our U.S. Marketplaces segment. Revenue from barter arrangements totaled $10.1 million in 2003,

$13.3 million in 2004 and $6.7 million in 2005. Certain judgments are involved in the determination of the

appropriate revenue recognition, including, but not limited to, the assessment and allocation of fair values in

multiple element arrangements, the appropriateness of gross or net revenue recognition and, for barter

transactions, the existence of comparable cash transactions to establish fair values. Our advertising and other

non-transaction net revenues may be affected by the financial condition of the parties with whom we have

these relationships and by the success of online services and promotions in general. Unlike our transaction

revenues, advertising and other non-transaction net revenues are derived from a relatively concentrated

customer base.

Business Combinations

The purchase price of an acquired company is allocated between intangible assets and the net tangible

assets of the acquired business with the residual of the purchase price recorded as goodwill. The determination

of the value of the intangible assets acquired involves certain judgments and estimates. These judgments can

include, but are not limited to, the cash flows that an asset is expected to generate in the future and the

appropriate weighted average cost of capital.

68