eBay 2005 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

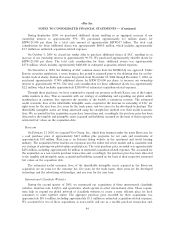

During September 2004, we purchased additional shares resulting in an aggregate increase of our

ownership interest to approximately 97%. We purchased approximately 4.5 million shares for

KRW125,000 per share for a total cash amount of approximately KRW557 billion. The total cash

consideration for these additional shares was approximately $484.8 million, which includes approximately

$1.7 million in estimated acquisition-related expenses.

On October 5, 2004 we closed our tender offer to purchase additional shares of IAC, resulting in an

increase of our ownership interest to approximately 99.7%. We purchased approximately 344,000 shares for

KRW125,000 per share. The total cash consideration for these additional shares was approximately

$37.8 million, which includes approximately $400,000 in estimated acquisition-related expenses.

On December 6, 2004, the delisting of IAC common shares from the KOSDAQ was approved. Under

Korean securities regulations, a seven business day period is required prior to the delisting date for on-the-

market trade of shares. During that seven day period, from November 25, 2004 through December 3, 2004, we

purchased approximately 17,000 additional shares for KRW125,000 per share, to increase our ownership

interest to approximately 99.9%. The total cash consideration for these additional shares was approximately

$2.2 million, which includes approximately $200,000 of estimated acquisition-related expenses.

Through these purchases, we have continued to expand our presence in South Korea, one of the largest

online markets in Asia. This is consistent with our strategy of establishing and expanding our global online

marketplaces in countries that represent the majority of the world's e-commerce revenue. The estimated

useful economic lives of the identifiable intangible assets acquired in the increase in ownership of IAC are

eight years for the user base, five years for the trade name, and two years for the developed technology. The

identifiable intangible assets are being amortized using the straight-line method over their useful economic

lives. We accounted for this acquisition as purchase transactions and, accordingly, the purchase price has been

allocated to the tangible and intangible assets acquired and liabilities assumed on the basis of their respective

estimated fair values on the acquisition date.

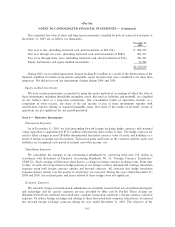

Rent.com

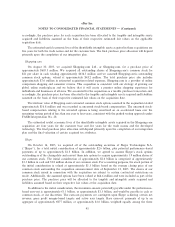

On February 23, 2005, we acquired Viva Group, Inc., which does business under the name Rent.com, for

a cash purchase price of approximately $415 million plus payments for net cash and investments of

approximately $18 million. Rent.com is an Internet listing website in the apartment and rental housing

industry. The acquisition better enables our expansion into the online real estate market and is consistent with

our strategy of growing our global online marketplaces. The total purchase price recorded was approximately

$435 million, including approximately $2 million in estimated acquisition-related expenses. We accounted for

the acquisition as a non-taxable purchase transaction and, accordingly, the purchase price has been allocated

to the tangible and intangible assets acquired and liabilities assumed on the basis of their respective estimated

fair values on the acquisition date.

The estimated useful economic lives of the identifiable intangible assets acquired in the Rent.com

acquisition are six years for the customer list, five years for the trade name, three years for the developed

technology and the advertising relationships, and one year for the user base.

International Classifieds Websites

During the second quarter of 2005, we announced our acquisitions of three international classifieds

websites, Gumtree.com, LoQUo, and opusforum, which operate in select international cities. These acquisi-

tions help us expand our global network of classifieds websites to create a more efficient place for local

consumers to come together online. The aggregate purchase price recorded for these acquisitions was

approximately $81.6 million, including approximately $1.3 million in estimated acquisition-related expenses.

We accounted for two of these acquisitions as non-taxable and one as a taxable purchase transaction and,

94