eBay 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

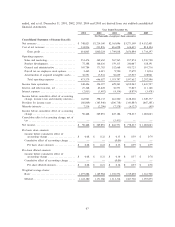

Executive Operating and Financial Summary

Our focus is on understanding our key operating and financial metrics

Members of our senior management team regularly review key operating metrics such as new users, new

user accounts, active users, listings and gross merchandise volume, as well as total payment volume processed

by our wholly owned PayPal subsidiary and number of users registered with our Skype subsidiary. Members of

our senior management also regularly review key financial information including net revenues, operating

income margins, earnings per share, cash flows from operations and free cash flows, which we define as

operating cash flows less purchases of property and equipment, net. These operating and financial measures

allow us to monitor the health and vibrancy of our Marketplaces, Payments, and Communications platforms

and the profitability of our business and to evaluate the effectiveness of investments that we have made and

continue to make in the areas of international expansion, customer support, product development, marketing

and site operations. We believe that an understanding of these key operating and financial measures and how

they change over time is important to investors, analysts and other parties analyzing our business results and

future market opportunities.

Our expectations for growth

We expect that our growth in net revenues during 2006 will result primarily from increased net

transaction revenues across our U.S. Marketplaces, International Marketplaces, Payments and Communica-

tions segments. We continue to make investments in our business and infrastructure to help us achieve our

long-term growth objectives. We expect to continue our investments in the areas of international expansion for

our eBay Marketplaces, our Payments and Communications businesses, customer support, site operations,

marketing and various corporate infrastructure areas. We believe these investments are necessary to support

the long-term demands of our growing business as well as to build the infrastructure necessary to support long-

term growth. In addition, to the extent that the U.S. dollar strengthens against foreign currencies, and, in

particular, the Euro, British pound and Korean won, the remeasurement of these foreign currency denomi-

nated transactions into U.S. dollars will negatively impact our consolidated net revenues and, to the extent that

they are not hedged, our net income.

The discussion of our consolidated financial results contained herein is intended to assist investors,

analysts and other parties reading this report to better understand the key operating and financial measures

summarized above as well as the changes in our consolidated results of operations from year to year, and the

primary factors that accounted for those changes.

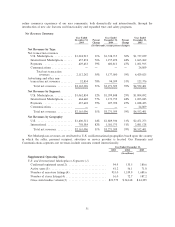

Seasonality

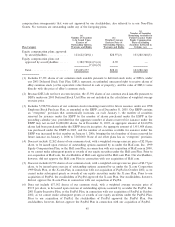

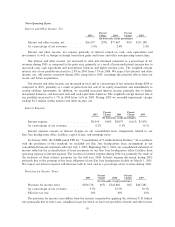

The following table sets forth, for the periods presented, our total net revenues and the sequential

quarterly growth of these net revenues.

March 31 June 30 September 30 December 31

(In thousands, except percentages)

2003

Net revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 476,492 $ 509,269 $ 530,942 $ 648,393

Current quarter vs prior quarter ÏÏÏÏÏÏ 15% 7% 4% 22%

2004

Net revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 756,239 $ 773,412 $ 805,876 $ 935,782

Current quarter vs prior quarter ÏÏÏÏÏÏ 17% 2% 4% 16%

2005

Net revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,031,724 $1,086,303 $1,105,515 $1,328,859

Current quarter vs prior quarter ÏÏÏÏÏÏ 10% 5% 2% 20%

We have historically experienced our strongest quarters of sequential growth in the first and fourth fiscal

quarters. We expect transaction activity patterns on our websites to increasingly mirror general consumer

49