eBay 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(7) Does not include 445,623 shares of our common stock, with a weighted average exercise price of

$8.42 per share, to be issued upon exercise of outstanding options assumed by us under the Shopping.com

Ltd. 2003 Omnibus Stock Option and Restricted Stock Incentive Plan, or the Shopping.com 2003 Plan,

in connection with our acquisition of Shopping.com Ltd. in August 2005, as we cannot make subsequent

grants or awards of our equity securities under the Shopping.com 2003 Plan. Prior to our acquisition of

Shopping.com, the stockholders of Shopping.com approved the 2003 Shopping.com 2003 Plan. Our

stockholders, however, did not approve the Shopping.com 2003 Plan in connection with our acquisition of

Shopping.com.

(8) Does not include 1,153,067 shares of our common stock, with a weighted average exercise price of

$36.19 per share, to be issued upon exercise of outstanding options assumed by us under the

Shopping.com Ltd. 2004 Equity Incentive Plan, or the Shopping.com 2004 Plan, in connection with our

acquisition of Shopping.com in August 2005, as we cannot make subsequent grants or awards of our

equity securities under the Shopping.com 2004 Plan. Prior to our acquisition of Shopping.com, the

stockholders of Shopping.com approved the Shopping.com 2004 Plan. Our stockholders, however, did not

approve the Shopping.com 2004 Plan in connection with our acquisition of Shopping.com.

(9) Does not include 1,822,090 shares of our common stock, with a weighted average exercise price of

$4.02 per share, to be issued upon exercise of outstanding options assumed by us under the Skype

Technologies S.A. Stock Option Plan Rules, or the Skype Plan, in connection with our acquisition of

Skype Technologies S.A. in October 2005, as we cannot make subsequent grants or awards of our equity

securities under the Skype Plan. Prior to our acquisition of Skype, the stockholders of Skype approved the

Skype Plan. Our stockholders, however, did not approve the Skype Plan in connection with our

acquisition of Skype.

The only outstanding Non-Plan Grant as of December 31, 2005 relates to an individual compensation

arrangement that was made prior to the initial public offering of our Common Stock in 1998. At the time of

this Non-Plan Grant, members of our Board and their affiliates beneficially owned in excess of 90% of our

then outstanding equity and voting interests. This Non-Plan Grant has been previously disclosed in our initial

public offering Prospectus filed with the SEC on September 25, 1998 under the headings ""Management Ì

Director Compensation'' and ""Ì Compensation Arrangements.'' Except as set forth below, the terms and

conditions of this Non-Plan Grant are identical to the terms of our 1997 Stock Option Plan, a copy of which

was filed as an exhibit to our S-1 Registration Statement (No. 33-59097) filed in connection with our initial

public offering.

The outstanding Non-Plan Grant involved the Board's grant of an option to purchase 3,600,000 shares of

our Common Stock at an exercise price of $0.39 to Mr. Cook upon his joining our Board in June 1998 as an

independent director. These options granted to Mr. Cook were non-qualified options and were immediately

exercisable, with a term of 10 years. These options vested as to 25% of the underlying shares in June 1999 and

as to 2.08% of the shares each month thereafter until they fully vested in June 2002. Mr. Cook exercised

options to purchase 480,000 shares in 2002, exercised options to purchase 1,430,000 shares in 2003, and

exercised options to purchase 307,272 shares during 2005. As of December 31, 2005, options to purchase

1,382,728 shares remain outstanding under the Non-Plan Grant.

Issuer Purchases of Equity Securities

We did not repurchase any of our equity securities during the quarter ended December 31, 2005.

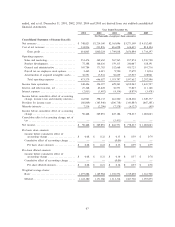

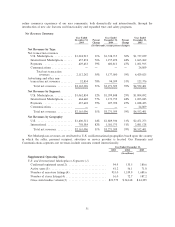

ITEM 6: SELECTED FINANCIAL DATA

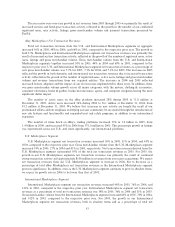

The following selected consolidated financial and supplemental operating data should be read in

conjunction with the consolidated financial statements and notes thereto and ""Management's Discussion and

Analysis of Financial Condition and Results of Operations'' appearing elsewhere in this Annual Report on

Form 10-K. The consolidated statement of income and the consolidated balance sheet data for the years

46