eBay 2005 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

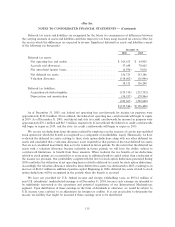

Accounting for Stock Compensation under APB Opinion No. 25 and FASB Interpretation No. 44'', to

remeasure the portion of an individual's options that were unvested at the date of the change in status. The

remeasurement is required to be at fair value and will continue to be revalued over the period of performance.

The related stock-based compensation amortization recognized during the year ended December 31, 2005

totaled approximately $6.7 million. The fair value of these unvested options have been estimated using the

Black-Scholes option pricing model with the following weighted average assumptions: risk-free interest rate,

4.43%; effective contractual life, 3 years; dividend yield, 0%; and expected volatility, 35%.

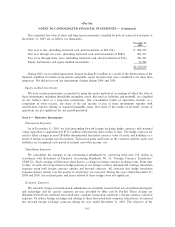

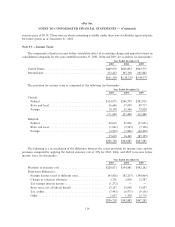

The following table summarizes additional stock option information related to grants made to our

employees and grants made specifically to named officers, which include our chief executive officer and the

other four most highly compensated officers during the year (in thousands, except percentages):

Year Ended December 31,

2003 2004 2005

Total outstanding shares of common stock (at period end) 1,298,586 1,338,608 1,404,184

As a percentage of total outstanding shares of common

stock:

Grants during the period ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 4% 3% 2%

Total outstanding ""in-the-money'' grants ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 11% 10% 8%

Total outstanding grants ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 11% 10% 9%

Grants to named officers during the period ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ * * *

Total outstanding grants to named officers ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1% 1% 1%

Total stock option grants during the period ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 53,388 43,628 34,991

Grants to named officers during the period as a percent of

total grants during the period ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 9% 7% 4%

Total outstanding stock option grants (at period end) ÏÏÏÏÏ 138,410 137,208 129,109

Total outstanding grants to named officers as a percent of

total stock option grants outstanding ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 11% 11% 11%

* Less than half of a percentage point

Non-stockholder approved stock option grants

Prior to our initial public offering in 1998, our Board of Directors approved three stock option grants

outside of formally approved stockholder plans to two independent directors upon their joining our Board of

Directors and to an executive officer upon his hiring. All of such option grants vested over 25% one year from

the date of grant, with the remainder vesting at a rate of 2.08% per month thereafter and expire 10 years from

the date of grant. The options granted to the independent directors were immediately exercisable, subject to

repurchase rights held by us, which lapse over the vesting period. The terms and conditions of such grants are

otherwise identical to nonqualified option grants made under the stock option plan in effect at that time. At

the time of such grants, members of our Board of Directors (and their affiliates) beneficially owned in excess

of 90% of our then outstanding voting interests. We have previously disclosed such option grants in our

Prospectus filed with the Securities and Exchange Commission on September 25, 1998 in connection with our

initial public offering under the headings ""Management Ì Director Compensation'' and ""Management Ì

Compensation Arrangements.'' Prior to 2004, one director and the executive officer had exercised all available

options under their respective grants. At December 31, 2005, one grant remained outstanding to one

independent director, with 1,383,000 shares to be issued upon exercise of the outstanding options at an average

113