eBay 2005 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

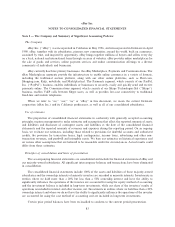

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

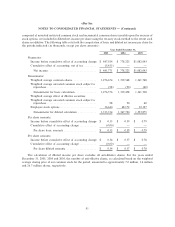

represent an accumulation of the estimated amounts necessary to provide for transaction losses incurred as of

the reporting date, including those to which we have not yet been notified. The allowances, which involve the

use of actuarial techniques, are monitored monthly and are updated based on actual claims data reported by

our claims processors. The allowances are based on known facts and circumstances, internal factors including

our experience with similar cases, historical trends involving loss payment patterns and the mix of transaction

and loss types. Additions to the allowance, in the form of provisions, are reflected as a general and

administrative expense in our consolidated statement of income. At December 31, 2004 and 2005, the

allowance for transaction losses totaled $11.0 million and $20.2 million, respectively, and was included in

accrued expenses and other current liabilities in our consolidated balance sheet.

Foreign currency

Substantially all of our foreign subsidiaries use the local currency of their respective countries as their

functional currency. Assets and liabilities are translated at exchange rates prevailing at the balance sheet

dates. Revenues, costs and expenses are translated into United States dollars at average exchange rates for the

period. Gains and losses resulting from translation are recorded as a component of accumulated other

comprehensive income (loss).

Realized gains and losses from foreign currency transactions are recognized as interest and other income,

net.

Funds receivable and funds payable to customers

Funds receivable and payable relate to our Payments segment and arise due to the time taken to clear

transactions through external payment networks. When customers fund their account using their bank account

or credit card, or withdraw money from their bank account or through a debit card transaction, there is a

clearing period before the cash is received or sent by PayPal, usually two or three business days for

U.S. transactions, and up to five to eight business days for international transactions. Hence, these funds are

treated as a receivable or payable until the cash is settled.

Customer accounts

As an agent on behalf of our customers we deposit all U.S.-based customer funds held in U.S. dollars into

Federal Deposit Insurance Corporation (FDIC) insured bank accounts or PayPal's Money Market Fund.

FDIC insurance is available to U.S.-based PayPal customers if we (1) place pooled customer funds in bank

accounts denominated "PayPal as Agent for the Benefit of its Customers' or similar caption, (2) maintain

records sufficient to identify the claim of each customer in the FDIC-insured account, (3) comply with

applicable FDIC recordkeeping requirements, and (4) truly operate as an agent of our customers. These

customer funds held by us as an agent on behalf of customers are not reflected on our consolidated balance

sheet. Additionally, we receive a custodial credit from our service provider in the form of a reduction in

transaction processing fees based upon balances held with each institution. This credit is recognized as a

reduction in processing costs in cost of revenues.

Effective February 13, 2004, PayPal customers resident in the European Union began to receive services

through PayPal's U.K. subsidiary, which holds an electronic money issuer license. Electronic Money

Institution, or ELMI, regulations require that customer balances in the U.K. subsidiary be represented as

claims on the subsidiary (held as a principal rather than as an agent) and invested only in specified types of

liquid assets. These customer balances are therefore included on our consolidated balance sheet as other

current assets with the corresponding amount due to customers reflected as a liability.

85