eBay 2005 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

technologies that enable and better protect online transactions, including the purchase of up to one million

two-factor authentication tokens.

We accounted for the acquisition as a purchase transaction and, accordingly, the purchase price has been

allocated to the tangible and intangible assets acquired and liabilities assumed on the basis of their respective

estimated fair values on the acquisition date. The estimated useful economic lives of the identifiable intangible

assets acquired in the acquisition are five years for registered user base and existing technology and one year

for the trade names. The final purchase price allocation will depend primarily upon the completion of our

integration plan.

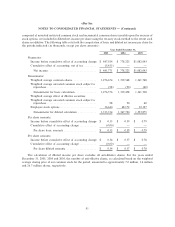

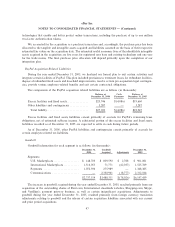

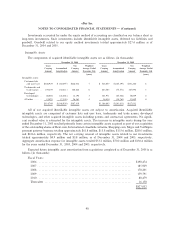

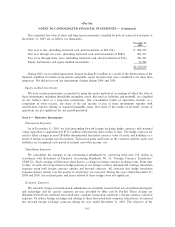

PayPal Acquisition-Related Liabilities

During the year ended December 31, 2003, we finalized our formal plan to exit certain activities and

integrate certain facilities of PayPal. This plan included provisions to terminate leases for redundant facilities,

dispose of redundant fixed assets and leasehold improvements, resolve certain pre-acquisition legal contingen-

cies, provide various employee-related benefits and exit certain contractual obligations.

The components of the PayPal acquisition related liabilities are as follows (in thousands):

Balance at Cash Balance at

December 31, 2004 Payments December 31, 2005

Excess facilities and fixed assetsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $23,746 $(4,086) $19,660

Other liabilities and contingencies ÏÏÏÏÏÏÏÏÏÏÏÏÏ 3,287 Ì 3,287

Total liabilityÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $27,033 $(4,086) $22,947

Excess facilities and fixed assets liabilities consist primarily of accruals for PayPal's remaining lease

obligations, net of estimated sublease income. A substantial portion of the excess facilities and fixed assets

liabilities recorded as of December 31, 2005 are expected to settle in cash during future periods.

As of December 31, 2005, other PayPal liabilities and contingencies consist primarily of accruals for

certain employee-related tax liabilities.

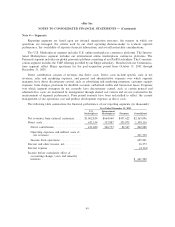

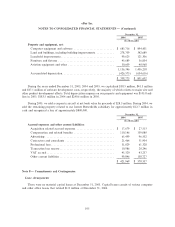

Goodwill

Goodwill information for each segment is as follows (in thousands):

December 31, Goodwill December 31,

2004 Acquired Adjustments 2005

Segments:

U.S. Marketplaces ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 148,703 $ 809,590 $ 2,788 $ 961,081

International Marketplaces ÏÏÏÏÏÏÏÏÏÏÏ 1,516,055 71,771 (62,037) 1,525,789

Payments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,072,396 275,989 Ì 1,348,385

Communications ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 2,330,961 (18,777) 2,312,184

$2,737,154 $3,488,311 $(78,026) $6,147,439

The increase in goodwill acquired during the year ended December 31, 2005, resulted primarily from our

acquisition of the outstanding shares of Rent.com, International classifieds websites, Shopping.com, Skype,

and VeriSign's payment gateway business, as well as certain insignificant acquisitions. Adjustments to

goodwill during the year ended December 31, 2005, resulted primarily from foreign currency translation

adjustments relating to goodwill and the release of certain acquisition liabilities associated with our current

and prior period acquisitions.

97