eBay 2005 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

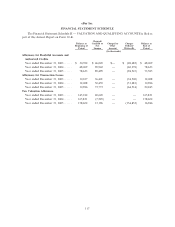

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

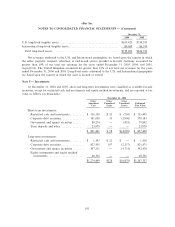

month purchase period. Employees may purchase shares having a value not exceeding 10% of their gross

compensation during an offering period. During the years ended December 31, 2003, 2004, and 2005,

employees purchased approximately 1.2 million, 1.2 million, and 1.4 million shares at average prices of $12.79,

$20.66 and $25.55 per share, respectively. At December 31, 2005, approximately 5.8 million shares of

common stock were reserved for future issuance. Our employee stock purchase plan contains an ""evergreen''

provision that automatically increases, on each January 1, the number of shares reserved for issuance under

the employee stock purchase plan by the number of shares purchased under this plan in the preceding calendar

year.

Employee Savings Plans

We have a savings plan, which qualifies under Section 401(k) of the Internal Revenue Code.

Participating employees may contribute up to 25% of their annual salary, but not more than statutory limits.

We contribute one dollar for each dollar a participant contributes, with a maximum contribution of $1,500 per

employee. Our non-U.S. employees are covered by various other savings plans. Our expenses for these plans

were $3.9 million in 2003, $5.6 million in 2004 and $8.6 million in 2005.

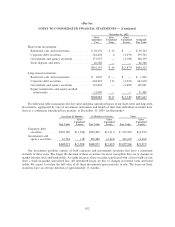

Stock Unit Plan

We have a deferred stock unit plan under which deferred stock units have been granted to new non-

employee directors elected to our Board of Directors after December 31, 2002. Under this plan, each new

director receives a one-time grant of deferred stock units equal to the result of dividing $150,000 by the fair

market value of our common stock on the date of grant. Each deferred stock unit constitutes an unfunded and

unsecured promise by us to deliver one share of our common stock (or the equivalent value thereof in cash or

property at our election). Each deferred stock unit award granted to a new non-employee director upon

election to the Board vests 25% one year from the date of grant, and at a rate of 2.08% per month thereafter. If

the services of the director are terminated at any time, all rights to the unvested deferred stock units shall also

terminate. In addition, directors may elect to receive, in lieu of annual retainer and committee chair fees and

at the time these fees would otherwise be payable (i.e., on a quarterly basis in arrears for services provided),

fully vested deferred stock units with an initial value equal to the amount of these fees. Deferred stock units

are payable following the termination of a director's tenure as a director. All eBay officers, directors and

employees are eligible to receive awards under the plan, although, to date, awards have been made only to new

non-employee directors. As of December 31, 2005, 27,391 units have been awarded under this plan.

Equity Incentive Plans

We have equity incentive plans for directors, officers and employees. Stock options granted under these

plans generally vest 25% one year from the date of grant (or 12.5% six months from the date of grant for grants

to existing employees) and the remainder vest at a rate of 2.08% per month thereafter, and generally expire

10 years from the date of grant. Stock options issued prior to June 1998, were exercisable immediately, subject

to repurchase rights held by us, which lapsed over the vesting period. Shares of restricted stock issued under

these plans are subject to repurchase by us at such times as determined by the Board of Directors, typically

five years. At December 31, 2005, 93.5 million shares were available for future grant.

111