eBay 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the weighted-average foreign currency exchange rates from 2004 were applied to our cost of revenues and

operating expenses for 2005, these costs of revenues and operating expenses would have been lower in total

than reported using the actual exchange rates for 2005 by approximately $5.6 million. The majority of this

impact relates to the relative strength of the Euro against the U.S. dollar.

We expect our international operations will continue to grow in significance as we develop and deploy our

global marketplaces and global payments platform. As a result, the impact of foreign currency fluctuations in

future periods could become more significant and may have a negative impact on our consolidated net

revenues and net income in the event the U.S. dollar strengthens relative to other currencies. See the

information in Item 7A under ""Foreign Currency Risk'' for additional discussion of the impact of foreign

currency translation and related hedging activities.

Foreign Exchange Hedging Policy

We are a rapidly growing company, with an increasing proportion of our operations outside the United

States. Accordingly, our foreign currency exposures have increased substantially and are expected to continue

to grow. The objective of our foreign exchange exposure management program is to identify material foreign

currency exposures and to manage these exposures to minimize the potential effects of currency fluctuations

on our reported consolidated cash flow, and results of operations.

Our primary foreign currency exposures are transaction, economic and translation:

Transaction Exposure: Around the world, we have certain assets and liabilities, primarily receivables,

investments and accounts payable (including inter-company transactions) that are denominated in currencies

other than the relevant entity's functional currency. In certain circumstances, changes in the functional

currency value of these assets and liabilities create fluctuations in our reported consolidated financial position,

results of operations and cash flows. We may enter into foreign exchange forward contracts or other

instruments to minimize the short-term foreign currency fluctuations on such assets and liabilities. The gains

and losses on the foreign exchange forward contracts offset the transaction gains and losses on certain foreign

currency receivables, investments and payables recognized in earnings.

Economic Exposure: We also have anticipated and unrecognized future cash flows, including revenues

and expenses, denominated in currencies other than the relevant entity's functional currency. Our primary

economic exposures include future royalty receivables, customer collections, and vendor payments. Changes in

the relevant entity's functional currency value will cause fluctuations in the cash flows we expect to receive

when these cash flows are realized or settled. We may enter into foreign exchange forward contracts or other

derivatives to hedge the value of a portion of these cash flows. We account for these foreign exchange

contracts as cash flow hedges. The effective portion of the derivative's gain or loss is initially reported as a

component of accumulated other comprehensive income (loss) and subsequently reclassified into earnings

when the transaction is settled.

Earnings Translation Exposure: As our international operations grow, fluctuations in the foreign

currencies create volatility in our reported results of operations because we are required to consolidate the

results of operations of our foreign denominated subsidiaries. We may decide to purchase forward exchange

contracts or other instruments to offset the earnings impact of currency fluctuations. Such contracts will be

marked-to-market on a monthly basis and any unrealized gain or loss will be recorded in interest and other

income, net.

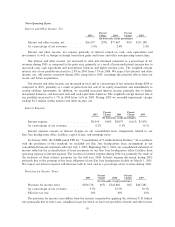

Employee Stock Options

We continue to believe that employee stock options represent an appropriate and essential component of

our overall compensation program. We grant options to substantially all employees and believe that this broad-

based program helps us to attract, motivate, and retain high quality employees, to the ultimate benefit of our

stockholders. Stock options granted during the year ended December 31, 2005, net of cancellations,

represented approximately 2% of our total common stock outstanding as of December 31, 2005. This

represented a decrease from the approximately 3% of total common stock outstanding as of December 31,

61