UPS 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

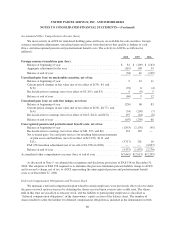

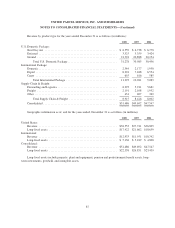

Supply Chain & Freight

Supply Chain & Freight includes our forwarding and logistics operations, UPS Freight, and other

aggregated business units. Our forwarding and logistics business provides services in more than 175 countries

and territories worldwide, and includes supply chain design and management, freight distribution, customs

brokerage, mail and consulting services. UPS Freight offers a variety of LTL and TL services to customers in

North America. Other aggregated business units within this segment include Mail Boxes, Etc. (the franchisor of

Mail Boxes, Etc. and The UPS Store) and UPS Capital.

In evaluating financial performance, we focus on operating profit as a segment’s measure of profit or loss.

Operating profit is before investment income, interest expense, and income taxes. The accounting policies of the

reportable segments are the same as those described in the summary of accounting policies (see Note 1), with

certain expenses allocated between the segments using activity-based costing methods. Unallocated assets are

comprised primarily of cash, marketable securities, short-term investments, and certain real estate investments.

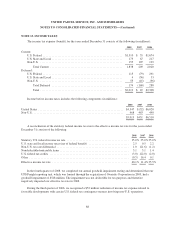

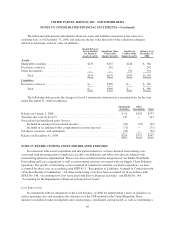

Segment information as of, and for the years ended, December 31 is as follows (in millions):

2008 2007 2006

Revenue:

U.S. Domestic Package .......................................... $31,278 $30,985 $30,456

International Package ............................................ 11,293 10,281 9,089

Supply Chain & Freight .......................................... 8,915 8,426 8,002

Consolidated ............................................... $51,486 $49,692 $47,547

Operating Profit (Loss):

U.S. Domestic Package .......................................... $ 3,907 $ (1,531) $ 4,923

International Package ............................................ 1,580 1,831 1,710

Supply Chain & Freight .......................................... (105) 278 2

Consolidated ............................................... $ 5,382 $ 578 $ 6,635

Assets:

U.S. Domestic Package .......................................... $18,796 $23,756 $19,274

International Package ............................................ 5,723 5,994 5,496

Supply Chain & Freight .......................................... 6,775 7,606 7,150

Unallocated .................................................... 585 1,686 1,290

Consolidated ............................................... $31,879 $39,042 $33,210

Depreciation and Amortization Expense:

U.S. Domestic Package .......................................... $ 1,031 $ 979 $ 989

International Package ............................................ 588 546 547

Supply Chain & Freight .......................................... 195 220 212

Consolidated ............................................... $ 1,814 $ 1,745 $ 1,748

86