UPS 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

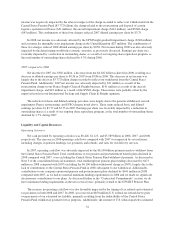

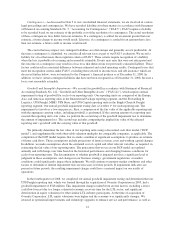

Contractual Commitments

We have contractual obligations and commitments in the form of capital leases, operating leases, debt

obligations, purchase commitments, pension fundings, and certain other liabilities. We intend to satisfy these

obligations through the use of cash flow from operations. The following table summarizes the expected cash

outflow to satisfy our contractual obligations and commitments as of December 31, 2008 (in millions):

Year

Capital

Leases

Operating

Leases

Debt

Principal

Debt

Interest

Purchase

Commitments

Pension

Fundings

Other

Liabilities

2009 .......................... $ 83 $ 344 $2,007 $ 331 $ 708 $ 778 $ 74

2010 .......................... 121 288 18 326 658 593 71

2011 .......................... 29 217 5 326 667 828 69

2012 .......................... 30 147 22 325 406 945 67

2013 .......................... 31 109 1,768 285 — 964 65

After 2013 ..................... 246 423 5,658 4,526 — — 139

Total .......................... $540 $1,528 $9,478 $6,119 $2,439 $4,108 $485

Our capital lease obligations relate primarily to leases on aircraft. Capital leases, operating leases, and

purchase commitments, as well as our debt principal obligations, are discussed further in Note 8 to our

consolidated financial statements. The amount of interest on our debt was calculated as the contractual interest

payments due on our fixed-rate debt, in addition to interest on variable rate debt that was calculated based on

interest rates as of December 31, 2008. The calculations of debt interest do not take into account the effect of

interest rate swap agreements. For debt denominated in a foreign currency, the U.S. Dollar equivalent principal

amount of the debt at the end of the year was used as the basis to calculate future interest payments.

Purchase commitments represent contractual agreements to purchase goods or services that are legally

binding, the largest of which are orders for aircraft, engines, and parts. As of December 31, 2008, we maintain

orders for 27 Boeing 767-300ER freighters to be delivered between 2009 and 2012, and five Boeing 747-400F

aircraft scheduled for delivery during 2009 and 2010. These aircraft purchase orders will provide for the

replacement of existing capacity and anticipated future growth.

Pension fundings represent the anticipated required cash contributions that will be made to the UPS IBT

Pension Plan, which was established upon ratification of the national master agreement with the Teamsters, as

well as the UPS Retirement Plan and the UPS Pension Plan. These plans are discussed further in Note 5 to the

consolidated financial statements. The pension funding requirements were estimated under the provisions of the

Pension Protection Act of 2006 and the Employee Retirement Income Security Act of 1974, using discount rates,

asset returns, and other assumptions appropriate for these plans. To the extent that the funded status of these

plans in future years differs from our current projections, the actual contributions made in future years could

materially differ from the amounts shown in the table above.

As a result of losses experienced in the global equity markets, our U.S. domestic pension plans experienced

a negative return on assets of approximately 26% in 2008, however these losses did not trigger any minimum

funding requirement for contributions in 2009 in the UPS Retirement Plan or UPS Pension Plan. The amount of

any minimum funding requirement, as applicable, for these plans could change significantly in future periods,

depending on many factors, including future plan asset returns and discount rates. A sustained significant decline

in the world equity markets, and the resulting impact on our pension assets and investment returns, could result in

our domestic pension plans being subject to significantly higher minimum funding requirements. Such an

outcome could have a material adverse impact on our financial position and cash flows in future periods.

The contractual payments due under the “other liabilities” column primarily includes commitment payments

related to our investment in certain partnerships. The table above does not include approximately $388 million of

unrecognized tax benefits that have been recognized as liabilities in accordance with FASB Interpretation No. 48,

36