UPS 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

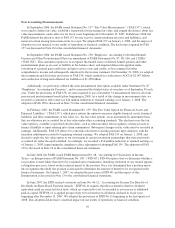

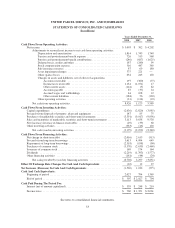

Pensions.” These assumptions include discount rates, health care cost trend rates, inflation, rate of compensation

increases, expected return on plan assets, mortality rates, and other factors. Actual results that differ from our

assumptions are accumulated and amortized over future periods and, therefore, generally affect our recognized

expense and recorded obligation in such future periods. We believe that the assumptions utilized in recording the

obligations under our plans are reasonable, and represent our best estimates, based on information as to historical

experience and performance as well as other factors that might cause future expectations to differ from past

trends. Differences in actual experience or changes in assumptions may affect our pension and other

postretirement obligations and future expense. A 25 basis point change in the assumed discount rate, expected

return on assets, and health care cost trend rate for the U.S. pension and postretirement benefit plans would result

in the following increases (decreases) on the Company’s costs and obligations for the year 2008 (in millions):

25 Basis Point

Increase

25 Basis Point

Decrease

Pension Plans

Discount Rate:

Effect on net periodic benefit cost .......................... $ (44) $ 52

Effect on projected benefit obligation ....................... (605) 639

Return on Assets:

Effect on net periodic benefit cost .......................... (42) 42

Postretirement Medical Plans

Discount Rate:

Effect on net periodic benefit cost .......................... (7) 6

Effect on accumulated postretirement benefit obligation ......... (80) 82

Health Care Cost Trend Rate:

Effect on net periodic benefit cost .......................... 2 (3)

Effect on accumulated postretirement benefit obligation ......... 25 (26)

Fair Value Measurements—In the normal course of business, we hold and issue financial instruments that

contain elements of market risk, including derivatives, marketable securities, finance receivables, other

investments, and debt. Certain of these financial instruments are required to be recorded at fair value, principally

derivatives, marketable securities, and certain other investments. Fair values are based on listed market prices,

when such prices are available. To the extent that listed market prices are not available, fair value is determined

based on other relevant factors, including dealer price quotations. Certain financial instruments, including

over-the-counter derivative instruments, are valued using pricing models that consider, among other factors,

contractual and market prices, correlations, time value, credit spreads, and yield curve volatility factors. Changes

in the fixed income, equity, foreign exchange, and commodity markets will impact our estimates of fair value in

the future, potentially affecting our results of operations. A quantitative sensitivity analysis of our exposure to

changes in commodity prices, foreign currency exchange rates, interest rates, and equity prices is presented in the

“Market Risk” section of this report.

Our assets and liabilities recorded at fair value have been categorized based upon a fair value hierarchy in

accordance with FAS 157. Level 1 inputs utilize quoted prices in active markets for identical assets or liabilities.

Level 2 inputs are based on other observable market data, such as quoted prices for similar assets and liabilities,

and inputs other than quoted prices that are observable, such as interest rates and yield curves. Level 3 inputs are

developed from unobservable data reflecting our own assumptions, and include situations where there is little or

no market activity for the asset or liability.

43