UPS 2008 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2008 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

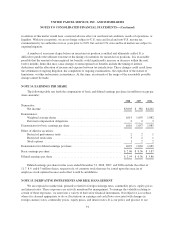

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

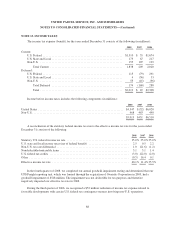

We have designated and account for these contracts as either hedges of the fair value of the associated debt

instruments, or as hedges of the variability in expected future interest payments. Any periodic settlement

payments are accrued monthly, as either a charge or credit to interest expense, and are not material to net income.

The net fair value of our interest rate swaps at December 31, 2008 and 2007 was a liability of $388 and $94

million, respectively.

Concurrent with the issuance of $4.0 billion in long-term fixed rate notes in January 2008, as discussed

further in Note 8, we settled certain derivatives that were designated as hedges of the borrowing costs of the

notes offering, resulting in a cash outflow of $84 million (which is reported in “other financing activities” on the

cash flow statement). This amount is amortized into expense as an adjustment to the effective yield over the life

of the individual bonds that were hedged.

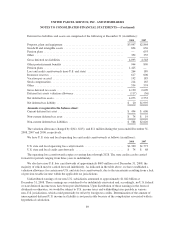

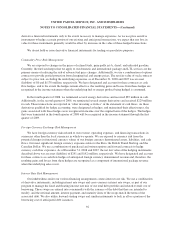

Credit Risk Management

The forward contracts, swaps, and options previously discussed contain an element of risk that the

counterparties may be unable to meet the terms of the agreements. However, we minimize such risk exposures

for these instruments by limiting the counterparties to financial institutions that meet established credit

guidelines. We do not expect to incur any material losses as a result of counterparty default.

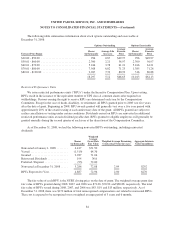

Income Effects of Derivatives

In the context of hedging relationships, “effectiveness” refers to the degree to which fair value changes in

the hedging instrument offset corresponding changes in the hedged item. Certain elements of hedge positions

cannot qualify for hedge accounting under FAS 133 whether effective or not, and must therefore be marked to

market through income. Both the effective and ineffective portions of gains and losses on hedges are reported in

the income statement category related to the hedged exposure. Ineffectiveness included in the income statement

was a loss of $12 million for 2007, and was immaterial for 2008 and 2006. The elements excluded from the

measure of effectiveness were immaterial for 2008, 2007 and 2006.

As of December 31, 2008, $191 million in pre-tax gains related to cash flow hedges that are currently

deferred in AOCI are expected to be reclassified to income over the 12 month period ending December 31, 2009.

The actual amounts that will be reclassified to income over the next 12 months will vary from this amount as a

result of changes in market conditions. No amounts were reclassified to income during 2008 in connection with

forecasted transactions that were no longer considered probable of occurring.

At December 31, 2008, the maximum term of derivative instruments that hedge forecasted transactions was

18 months.

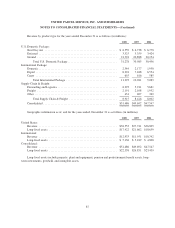

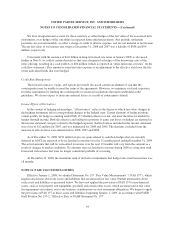

NOTE 16. FAIR VALUE DISCLOSURES

Effective January 1, 2008, we adopted Statement No. 157 “Fair Value Measurements” (“FAS 157”), which

requires disclosures about our assets and liabilities that are measured at fair value. Further information about

such assets and liabilities is presented below. We have not applied the provisions of FAS 157 to non-financial

assets, such as our property and equipment, goodwill and certain other assets, which are measured at fair value

for impairment assessment, nor to any business combinations or asset retirement obligations. We began to apply

the provisions of FAS 157 to these assets and liabilities beginning January 1, 2009, in accordance with FASB

Staff Position No. 157-2, “Effective Date of FASB Statement No. 157”.

93