UPS 2008 Annual Report Download - page 39

Download and view the complete annual report

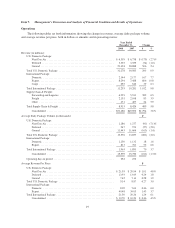

Please find page 39 of the 2008 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fund. Partially offsetting this was a $216 million increase in expense for UPS-sponsored pension plans in the

U.S., which was impacted by expense recognition now being required for the new UPS IBT Pension Plan.

Non-pension benefits expense increased largely due to higher employee health and welfare program costs, which

is impacted by medical cost inflation. Employee payroll costs increased due to contractual wage increases for our

union employees and normal merit increases for our non-union employees. Compensation and benefits expense

also declined due to the absence in 2008 of the SVSO and France restructuring charges, which had increased

compensation and benefits expense by $68 and $42 million in 2007, respectively.

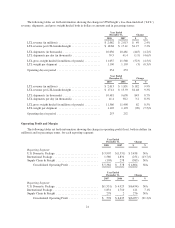

The 3.2% increase in repairs and maintenance was largely due to increased aircraft maintenance, somewhat

offset by reduced vehicle maintenance expense. The 4.0% increase in depreciation and amortization was

influenced by several factors, including higher depreciation expense on aircraft and vehicles resulting from new

deliveries, but partially offset by reduced amortization expense on capitalized software resulting from a decrease

in software development projects. The 11.0% increase in purchased transportation was driven by a combination

of higher volume in our international package and forwarding businesses, the impact of currency exchange rates,

and increased fuel surcharge rates charged to us by third-party carriers. The 39.0% increase in fuel expense was

impacted by higher prices for jet-A fuel, diesel, and unleaded gasoline as well as lower hedging gains. The 7.2%

increase in other occupancy expense was influenced by higher electricity and natural gas costs, as well as higher

rent and property tax expense. During the fourth quarter of 2008, declining energy prices impacted costs such as

purchased transportation, which decreased $132 million, or 7.6%, and fuel, which decreased $118 million, or

12.7%, compared with the fourth quarter of 2007.

Other expenses increased 14.9% for the year primarily due to goodwill and intangible asset impairment

charges. In addition, we also experienced increased expenses for leased transportation equipment, data

processing, advertising, professional services, and bad debts. These factors were partially offset by the absence in

2008 of a $221 million aircraft impairment charge recorded in 2007.

We test our goodwill for impairment annually, as of October 1st, on a reporting unit basis in accordance with

FASB Statement No. 142 “Goodwill and Other Intangible Assets” (“FAS 142”). Our reporting units are

comprised of the Europe, Asia, and Americas reporting units in the International Package reporting segment, and

the Forwarding & Logistics, UPS Freight, MBE / UPS Store, and UPS Capital reporting units in the Supply

Chain & Freight reporting segment. The impairment test involves a two-step process. First, a comparison of the

fair value of the applicable reporting unit with the aggregate carrying values, including goodwill, is performed.

We primarily determine the fair value of our reporting units using a discounted cash flow model, and supplement

this with observable valuation multiples for comparable companies, as applicable. If the carrying amount of a

reporting unit exceeds the reporting unit’s fair value, we perform the second step of the goodwill impairment test

to determine the amount of impairment loss. The second step includes comparing the implied fair value of the

affected reporting unit’s goodwill with the carrying value of that goodwill.

In the fourth quarter of 2008, we completed our annual goodwill impairment testing and determined that our

UPS Freight reporting unit, which was formed through the acquisition of Overnite Corporation in 2005, had a

goodwill impairment of $548 million. This impairment charge resulted from several factors, including a lower

cash flow forecast due to a longer estimated economic recovery time for the LTL sector, and significant

deterioration in equity valuations for other similar LTL industry participants. At the time of acquisition of

Overnite Corporation, LTL equity valuations were higher and the economy was significantly stronger. We

invested in operational improvements and technology upgrades to enhance service and performance, as well as

expand service offerings. However, this process took longer than initially anticipated, and thus financial results

have been below our expectations. Additionally, the LTL sector in 2008 has been adversely impacted by the

economic recession in the U.S., lower industrial production and retail sales, volatile fuel prices, and significant

levels of price-based competition. By the fourth quarter of 2008, the combination of these internal and external

factors reduced our near term expectations for this unit, leading to the goodwill impairment charge. None of the

other reporting units incurred an impairment of goodwill in 2008, nor did we have any goodwill impairment

charges in 2007 or 2006.

28