UPS 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

hedged item is recorded in income. Any portion of a change in a derivative’s fair value that is considered to be

ineffective, or is excluded from the measurement of effectiveness, is recorded immediately in income.

New Accounting Pronouncements

In June 2007, the EITF reached consensus on Issue No. 06-11, “Accounting for Income Tax Benefits of

Dividends on Share-Based Payment Awards.” EITF 06-11 requires that the tax benefit related to dividend

equivalents paid on restricted stock units, which are expected to vest, be recorded as an increase to additional

paid-in capital. EITF 06-11 is applied prospectively for tax benefits on dividends declared in fiscal years

beginning after December 15, 2007. We adopted the provisions of EITF 06-11 beginning in the first quarter of

2008. This adoption did not have a material impact on our results of operations or financial condition.

In December 2007, the FASB issued Statement No. 141(R) “Business Combinations” (“FAS 141(R)”). FAS

141(R) requires the acquiring entity in a business combination to recognize the full fair value of assets acquired

and liabilities assumed in the transaction (whether a full or partial acquisition); establishes the acquisition-date

fair value as the measurement objective for all assets acquired and liabilities assumed; requires expensing of most

transaction and restructuring costs; and requires the acquirer to disclose in its financial statements the

information needed to evaluate and understand the nature and financial effect of the business combination. FAS

141(R) applies prospectively to business combinations for which the acquisition date is on or after January 1,

2009. The impact of FAS No. 141(R) on our consolidated financial statements will depend upon the nature, terms

and size of the acquisitions we consummate after the effective date.

In December 2007, the FASB issued Statement No. 160, “Noncontrolling Interests in Consolidated

Financial Statements—an amendment of Accounting Research Bulletin No. 51” (“FAS 160”). FAS 160 requires

reporting entities to present noncontrolling (minority) interests as equity (as opposed to as a liability or

mezzanine equity) and provides guidance on the accounting for transactions between an entity and

noncontrolling interests. As of December 31, 2008, we had approximately $5 million in noncontrolling interests

classified in other non-current liabilities. FAS 160 applies prospectively as of January 1, 2009, except for the

presentation and disclosure requirements which will be applied retrospectively for all periods presented.

In March 2008, the FASB issued Statement No. 161, “Disclosures about Derivative Instruments and

Hedging Activities, an amendment of FASB Statement No. 133” (“FAS 161”), which requires additional

disclosures about the objectives of derivative instruments and hedging activities, the method of accounting for

such instruments under FAS 133 and its related interpretations, and a tabular disclosure of the effects of such

instruments and related hedged items on our financial position, financial performance, and cash flows. We

adopted FAS 161 on January 1, 2009. FAS 161 only impacts our disclosures, and does not impact our financial

position, results of operations, or cash flows. These new disclosures will be required for us beginning in our

Form 10-Q for the quarter ended March 31, 2009.

In October 2008, the FASB issued Staff Position No. FAS 157-3, “Determining the Fair Value of a

Financial Asset When the Market for That Asset is Not Active” (“FSP 157-3”). FSP 157-3 clarifies the

application of FAS 157, which we adopted as of January 1, 2008, in cases where a market is not active. We have

considered the guidance provided by FSP 157-3 in our determination of estimated fair values as of December 31,

2008, and the impact was not material.

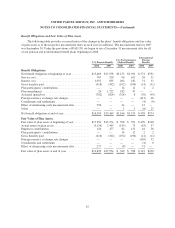

In December 2008, the FASB issued FSP FAS 132(R)-1, “Employers’ Disclosure about Postretirement

Benefit Plan Assets”, which amends Statement 132(R) to require more detailed disclosures about employers’

pension plan assets. New disclosures will include more information on investment strategies, major categories of

assets, concentrations of risk within plan assets, and valuation techniques used to measure the fair value of plan

58