UPS 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

NOTE 7. BUSINESS ACQUISITIONS AND DISPOSITIONS

In December 2004, we agreed with Sinotrans Air Transportation Development Co., Ltd. (“Sinotrans”) to

acquire direct control of the international express operations in 23 cities within China, and to purchase

Sintotrans’ interest in our current joint venture in China. As of December 31, 2006, we had made all cash

payments under the purchase agreement, a total of $114 million, and had taken direct control of operations in all

23 locations. The operations acquired are reported within our International Package reporting segment.

Pro forma results of operations have not been presented for this acquisition because the effects of this

transaction were not material. The results of operations are included in our statements of consolidated income

from the date of acquisition. The purchase price allocations of acquired companies can be modified up to one

year after the date of acquisition. No purchase price adjustments were made during 2008.

NOTE 8. DEBT OBLIGATIONS AND COMMITMENTS

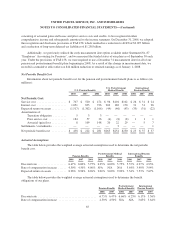

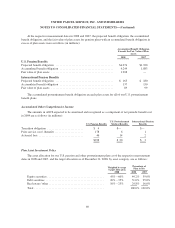

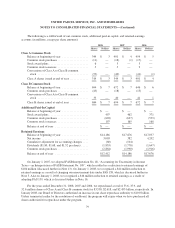

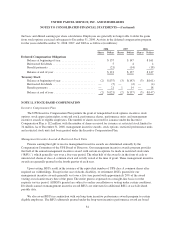

Debt obligations, as of December 31, consist of the following (in millions):

2008 2007

8.38% debentures .................................................. $ 741 $ 761

4.50% senior notes ................................................. 1,739 —

5.50% senior notes ................................................. 745 —

6.20% senior notes ................................................. 1,479 —

Commercial paper ................................................. 2,922 7,366

Floating rate senior notes ............................................ 438 441

Capital lease obligations ............................................ 425 479

Facility notes and bonds ............................................. 433 435

UPS Notes ....................................................... 198 513

Pound Sterling notes ............................................... 730 989

Other debt ........................................................ 21 34

Total debt ........................................................ 9,871 11,018

Less current maturities .............................................. (2,074) (3,512)

Long-term debt .................................................... $7,797 $ 7,506

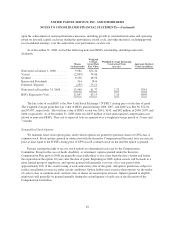

8.38% Debentures:

On January 22, 1998, we exchanged $276 million of an original $700 million in debentures for new

debentures of equal principal with a maturity of April 1, 2030. The new debentures have the same interest rate as

the 8.38% debentures due 2020 until April 1, 2020, and, thereafter, the interest rate will be 7.62% for the final 10

years. The 2030 debentures are redeemable in whole or in part at our option at any time. The redemption price is

equal to the greater of 100% of the principal amount and accrued interest, or the sum of the present values of the

remaining scheduled payout of principal and interest thereon discounted to the date of redemption at a

benchmark treasury yield plus five basis points plus accrued interest. The remaining $424 million of 2020

debentures are not subject to redemption prior to maturity. Interest is payable semiannually on the first of April

and October for both debentures and neither debenture is subject to sinking fund requirements. The fixed

obligations associated with the debentures were previously swapped to floating rates, based on six month LIBOR

plus a spread. Including the effect of the swaps, the average interest rate paid on the debentures for 2007 was

7.99%. The swaps were subsequently terminated, and the average interest rate paid on the debt in 2008 was

8.38%.

73