UPS 2008 Annual Report Download - page 36

Download and view the complete annual report

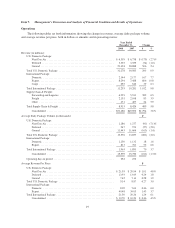

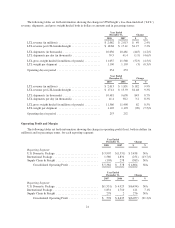

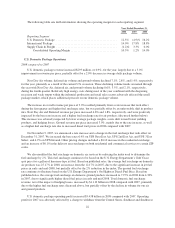

Please find page 36 of the 2008 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.International Package operating profit decreased $251 million, or 13.7%, in 2008, and the operating margin

declined to 14.0% from 17.8% in 2007. The decline in operating profit and operating margin were affected by

reduced asset utilization resulting from changes in economic conditions and trade flows, such as the reduced

import volume into the United States. Operating profit and margin were also negatively affected by a shift in

product mix away from our premium services, as well as expenses associated with integration activities in our

delivery network. Global economic weakness resulted in a weakening operating profit trend, with fourth quarter

operating profit declining 34.3%.

Because fuel costs decreased rapidly in the latter half of the year, operating profit benefited from the

approximate two month time lag between the fuel price changes and when the monthly surcharge rates are

applied to package shipments. As a result of this time lag, fuel positively impacted the change in operating profit

during 2008, which is opposite of the effect the company experienced in 2007, when fuel costs rose much faster

than the fuel surcharge rate and operating profit was adversely impacted. The change in operating profit was also

positively affected by $136 million during the year due to favorable currency exchange rates, net of hedging

activity.

Operating profit in 2008 was adversely impacted by a fourth quarter $27 million impairment charge

incurred on certain intangible assets in our domestic package business in the United Kingdom (discussed further

in the “Operating Expenses” section). Operating profit for 2007 was adversely affected by the aircraft

impairment and SVSO charges ($62 million of the aircraft impairment charge and $7 million of the SVSO charge

impacted the International Package segment), and the absence of these charges in 2008 favorably affected the

operating profit comparison between periods.

2007 compared to 2006

International Package revenue improved $1.192 billion, or 13.1% in 2007, driven by a 10.4% volume

increase for our export products and an 8.3% increase in total revenue per piece. The growth in revenue per piece

was positively impacted by base rate increases and the weakening of the U.S. Dollar against several major

foreign currencies in 2007, but was adversely affected by a lower fuel surcharge rate applied to our U.S. origin

international air products.

Export volume increased throughout the world. Asian export volume grew strongly in key markets during

the year, especially China. Asian export volume continues to benefit from our geographic service expansion, as

well as strong economic growth, which benefits our intra-Asian package business. To continue this expansion,

we received authority in 2007 to operate six daily flights between the U.S. and Nagoya, Japan, and began

constructing a package and freight air hub in Shanghai, China that will link Shanghai to our international air

network, with direct service to Europe, Asia, and the Americas.

European export volume also grew solidly, largely due to continued growth in the transborder business and

improved economic and industrial output in the European Union. U.S. export volume increased at a slower pace.

Non-U.S. domestic volume increased 2.2% for the year, and was impacted by growth in several major European

countries and Canada.

Export revenue per piece increased 3.9% for the year, largely due to rate increases and favorable exchange

rates, but was adversely impacted by relatively higher growth in lower revenue per piece transborder products,

and a reduction in certain fuel surcharge rates. Non-U.S. domestic revenue per piece increased 9.6% for the year,

and was affected by rate increases and favorable exchange rates. Total average revenue per piece increased 2.7%

on a currency-adjusted basis, and the overall change in segment revenue was positively affected by $464 million

in 2007 due to currency fluctuations, net of hedging activity.

In January 2007, we increased rates 6.9% for international shipments originating in the United States

(Worldwide Express, Worldwide Express Plus, UPS Worldwide Expedited and UPS International Standard

service). Rate changes for international shipments originating outside the United States vary by geographical

market and occur throughout the year.

25