UPS 2008 Annual Report Download - page 38

Download and view the complete annual report

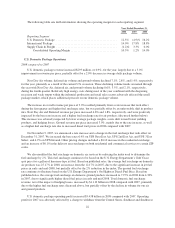

Please find page 38 of the 2008 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Operating profit for this segment was negatively impacted in 2007 by $8 million due to the SVSO charge

and by $46 million as a result of a charge for restructuring and disposing of certain non-core business units in

France, as discussed further in the “Operating Expenses” section. The absence of these charges in 2008 favorably

affected the operating profit comparison between periods.

2007 compared to 2006

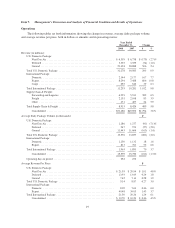

Supply Chain & Freight revenue increased $424 million, or 5.3%, in 2007. Forwarding and logistics revenue

increased $230 million, or 4.0%, for the year, and was affected by favorable exchange rate movements and

revenue management initiatives begun in 2006. Favorable exchange rate movements positively affected the

growth in revenue by $178 million during the year. Revenue growth in this business was driven by improvements

in international air freight and mail services, which were impacted by overall market growth and lower customer

turnover rates.

UPS Freight increased revenue $156 million, or 8.0%, for the year as a result of improved yields and a

strong increase in average daily shipment volume. Average LTL shipments per day increased 8.3% during the

year, driven by new customer wins and leveraging our existing small package customer base for new sales

opportunities. LTL revenue per hundredweight increased 9.3% during the year, due to an increase in base rates in

2007 and a focus on higher-yielding customer segments. The increase in revenue per hundredweight and average

daily shipments were somewhat offset by a 7.5% decrease for the year in the LTL weight per shipment.

The other businesses within Supply Chain & Freight, which include our retail franchising business, our

financial business, and our U.S. domestic cargo operations, increased revenue by 10.3% during the year. This

revenue growth was primarily due to increased revenue from our contract to provide domestic air transportation

services for the U.S. Postal Service.

Operating profit for the Supply Chain & Freight segment was $278 million in 2007, compared with a profit

of $2 million in 2006, resulting in a 330 basis point improvement in the operating margin. This improvement was

largely due to improved results in the forwarding and logistics business as a result of cost controls, a focus on

asset utilization, and revenue management initiatives. Cost improvements were realized as a result of the

restructuring program that began in 2006, which included a reduction of non-operating staff of approximately

1,400 people. Additionally, margin improvements are being realized by focusing on capacity utilization in the air

freight business, through better utilizing space available on our own aircraft. Finally, revenue management

initiatives put into place last year are producing better returns through reducing less profitable accounts, and

ensuring that new accounts meet specific criteria that allow us to better utilize our existing transportation assets.

Operating profit in 2007 for this segment was reduced by $46 million as a result of a charge for

restructuring and disposing of certain non-core business units in France, as well as by $8 million due to the

SVSO charge. These charges are discussed further in the “Operating Expenses” section. Currency fluctuations

positively affected the growth in operating profit by $18 million in 2007.

Operating Expenses

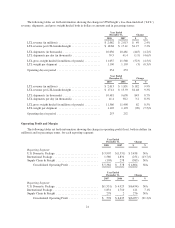

2008 compared to 2007

Consolidated operating expenses decreased by $3.010 billion, or 6.1%, for the year, primarily due to a

reduction in compensation and benefits expense. Currency fluctuations in our International Package and Supply

Chain & Freight segments accounted for approximately $342 million of increased operating expenses from 2007

to 2008.

Compensation and benefits expense decreased by $5.682 billion, or 17.9%, for the year, and was impacted

by several items. The primary reason for the decrease was a reduction in pension expense for our multiemployer

pension plans, largely relating to a $6.100 billion charge in 2007 to withdraw from the Central States Pension

27