UPS 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

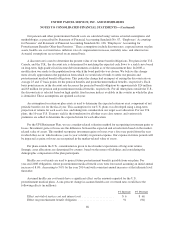

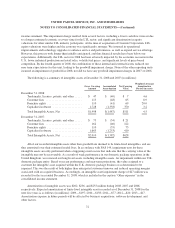

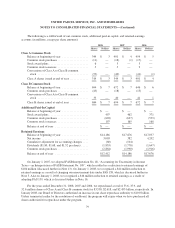

At the respective measurement dates in 2008 and 2007, the projected benefit obligation, the accumulated

benefit obligation, and the fair value of plan assets for pension plans with an accumulated benefit obligation in

excess of plan assets were as follows (in millions):

Accumulated Benefit Obligation

Exceeds the Fair Value of Plan

Assets

2008 2007

U.S. Pension Benefits

Projected benefit obligation ........................................ $4,274 $1,920

Accumulated benefit obligation ..................................... 4,249 1,883

Fair value of plan assets ........................................... 1,908 —

International Pension Benefits

Projected benefit obligation ........................................ $ 165 $ 180

Accumulated benefit obligation ..................................... 137 150

Fair value of plan assets ........................................... 89 99

The accumulated postretirement benefit obligation exceeds plan assets for all of our U.S. postretirement

benefit plans.

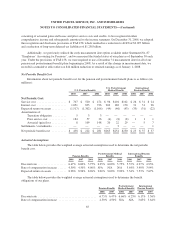

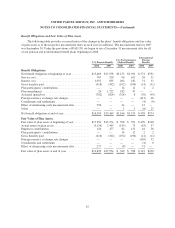

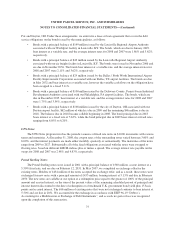

Accumulated Other Comprehensive Income

The amounts in AOCI expected to be amortized and recognized as a component of net periodic benefit cost

in 2009 are as follows (in millions):

U.S. Pension Benefits

U.S. Postretirement

Medical Benefits

International Pension

Benefits

Transition obligation ......................... $ 4 $— $—

Prior service cost / (benefit) .................... 178 6 1

Actuarial loss ............................... 46 14 2

$228 $ 20 $ 3

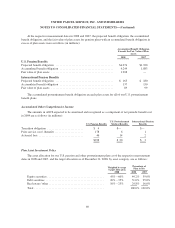

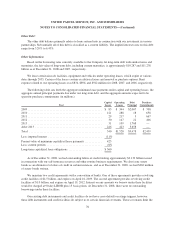

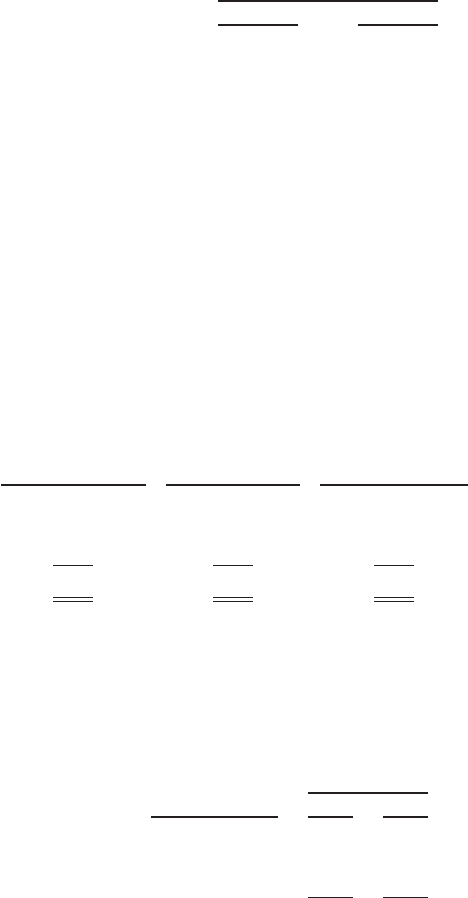

Plan Asset Investment Policy

The asset allocation for our U.S. pension and other postretirement plans as of the respective measurement

dates in 2008 and 2007, and the target allocation as of December 31, 2008, by asset category, are as follows:

Weighted Average

Target Allocation

2008

Percentage of

Plan Assets

2008 2007

Equity securities ....................................... 45%–60% 44.2% 59.0%

Debt securities ........................................ 20%–35% 31.0% 25.0%

Real estate / other ...................................... 10%–25% 24.8% 16.0%

Total ................................................ 100.0% 100.0%

69