UPS 2008 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2008 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

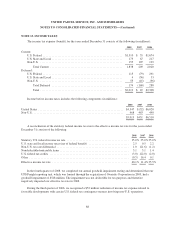

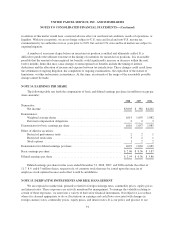

In February 2007, the FASB issued Statement No. 159 “The Fair Value Option for Financial Assets and

Financial Liabilities” (“FAS 159”), which gives entities the option to measure eligible financial assets, financial

liabilities and firm commitments at fair value (i.e., the fair value option), on an instrument-by-instrument basis,

that are otherwise not accounted for at fair value under other accounting standards. The election to use the fair

value option is available at specified election dates, such as when an entity first recognizes a financial asset or

financial liability or upon entering into a firm commitment. Subsequent changes in fair value must be recorded in

earnings. Additionally, FAS 159 allows for a one-time election for existing positions upon adoption, with the

transition adjustment recorded to beginning retained earnings. We adopted FAS 159 on January 1, 2008, and

elected to apply the fair value option to our investment in certain investment partnerships that were previously

accounted for under the equity method. Accordingly, we recorded a $16 million reduction to retained earnings as

of January 1, 2008, representing the cumulative effect adjustment of adopting FAS 159. These investments are

reported in “other non-current assets” on the consolidated balance sheet.

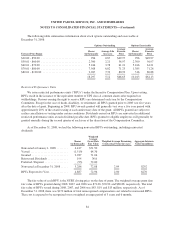

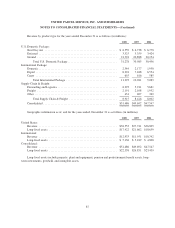

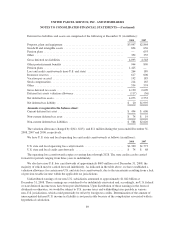

Our assets and liabilities recorded at fair value have been categorized based upon a fair value hierarchy in

accordance with FAS 157. Level 1 inputs utilize quoted prices in active markets for identical assets or liabilities.

Level 2 inputs are based on other observable market data, such as quoted prices for similar assets and liabilities,

and inputs other than quoted prices that are observable, such as interest rates and yield curves. Level 3 inputs are

developed from unobservable data reflecting our own assumptions, and include situations where there is little or

no market activity for the asset or liability.

The following is a general description of the valuation methodologies used for financial assets and liabilities

measured at fair value, including the general classification of such assets and liabilities pursuant to the valuation

hierarchy.

Marketable Securities – Marketable securities utilizing Level 1 inputs include active exchange-traded

equity securities and equity index funds, and most U.S. Government debt securities, as these securities all have

quoted prices in active markets. Marketable securities utilizing Level 2 inputs include non-auction rate asset-

backed securities, corporate bonds, and municipal bonds. These securities are valued using market corroborated

pricing, matrix pricing, or other models that utilize observable inputs such as yield curves.

We have classified our auction rate securities portfolio as utilizing Level 3 inputs, as their valuation requires

substantial judgment and estimation of factors that are not currently observable in the market due to the lack of

trading in the securities. These valuations may be revised in future periods as market conditions evolve. These

securities were valued as of December 31, 2008 considering several factors, including the credit quality of the

securities, the rate of interest received since the failed auctions began, the yields of securities similar to the

underlying auction rate securities, and the input of broker-dealers in these securities.

Derivative Contracts – Our foreign currency, interest rate, and energy derivatives are largely comprised of

over-the-counter derivatives, which are primarily valued using pricing models that rely on market observable

inputs such as yield curves, currency exchange rates, and commodity forward prices, and therefore are classified

as Level 2.

Other Investments—Financial assets and liabilities utilizing Level 3 inputs include our holdings in certain

investment partnerships. These partnership holdings do not have any quoted prices, nor can they be valued using

inputs based on observable market data. These investments are valued internally using a discounted cash flow

model based on each partnership’s financial statements and cash flow projections.

94