UPS 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

income tax payments was lower in 2007 compared with 2006, also primarily relating to the deductibility of the

pension withdrawal payment. As of December 31, 2008, we have received substantially all of the expected cash

tax benefits resulting from the withdrawal payment.

Changes in package volume and pricing affect operating cash flow. As noted previously, we increased rates

in our package delivery and LTL services at the end of 2007. Additionally, in October 2008, we announced a

base rate increase and a change in the fuel surcharge that took effect on January 5, 2009. We increased the base

rates 6.9% on UPS Next Day Air, UPS 2nd Day Air, and UPS 3 Day Select, and 5.9% on UPS Ground. We also

increased the base rates 6.9% for international shipments originating in the United States (Worldwide Express,

Worldwide Express Plus, UPS Worldwide Expedited and UPS International Standard service). Other pricing

changes included a $0.10 increase in the residential surcharge, and an increase of $0.10 in the delivery area

surcharge on both residential and commercial services to certain ZIP codes. These rate changes are customary,

and are consistent with previous years’ rate increases. Additionally, we modified the fuel surcharge on domestic

and U.S.-origin international air services by reducing by 2% the index used to determine the fuel surcharge. The

UPS Ground fuel surcharge continues to fluctuate based on the U.S. Energy Department’s On-Highway Diesel

Fuel Price. Rate changes for shipments originating outside the U.S. are made throughout the year and vary by

geographic market.

In October 2008, UPS Freight announced a general rate increase averaging 5.9% covering non-contractual

shipments in the United States and Canada. The increase took effect on January 5, 2009, and applies to minimum

charge, LTL and TL rates.

Investing Activities

Net cash used in investing activities was $3.179, $2.199, and $2.340 billion in 2008, 2007, and 2006,

respectively. The increase in cash used in 2008 compared with 2007 was primarily due to increased net purchases

of marketable securities. Net (purchases) sales of marketable securities were ($278), $621, and $482 million in

2008, 2007, and 2006, respectively. The net sales of marketable securities in 2007 and 2006 were primarily used

to fund our pension and postretirement medical benefit plans, as well as to repurchase shares.

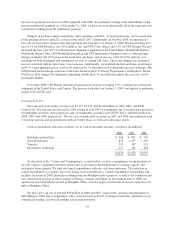

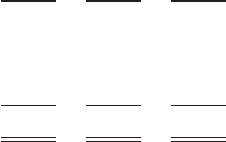

Capital expenditures represent a primary use of cash in investing activities, as follows (in millions):

2008 2007 2006

Buildings and facilities ....................................... $ 968 $ 853 $ 720

Aircraft and parts ........................................... 852 1,137 1,150

Vehicles .................................................. 539 492 831

Information technology ...................................... 277 338 384

$2,636 $2,820 $3,085

As described in the “Contractual Commitments” section below, we have commitments for the purchase of

aircraft, vehicles, equipment and other fixed assets to provide for the replacement of existing capacity and

anticipated future growth. We fund our capital expenditures with our cash from operations. The reduction in

capital expenditures was largely due to the timing of aircraft deliveries. Capital expenditures on buildings and

facilities increased in 2008, primarily resulting from our Worldport hub expansion, as well as the expansion and

new construction projects at other facilities in Europe, Canada, and China. In the fourth quarter of 2008, we

opened our new international air hub in Shanghai, China, and also began construction of our new intra-Asia air

hub in Shenzhen, China.

We had a net cash use of $49 and $39 million in 2008 and 2007, respectively, and net cash generation of

$68 million in 2006, due to originations, sales, and customer paydowns of finance receivables, primarily in our

commercial lending, asset-based lending, and leasing portfolios.

33