UPS 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

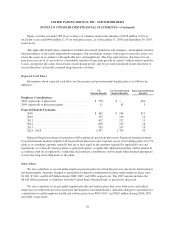

The UPS Retirement Plan is noncontributory and includes substantially all eligible employees of

participating domestic subsidiaries who are not members of a collective bargaining unit, as well as certain

employees covered by a collective bargaining agreement. This plan generally provides for retirement benefits

based on average compensation levels earned by employees prior to retirement. Benefits payable under this plan

are subject to maximum compensation limits and the annual benefit limits for a tax qualified defined benefit plan

as prescribed by the Internal Revenue Service.

The UPS Excess Coordinating Benefit Plan is a non-qualified plan that provides benefits to certain eligible

participants in the UPS Retirement Plan for amounts that exceed the benefit limits described above.

The UPS Pension Plan is noncontributory and includes certain eligible employees of participating domestic

subsidiaries and members of collective bargaining units that elect to participate in the plan. This plan provides for

retirement benefits based on service credits earned by employees prior to retirement. Additionally, retirement

benefits for certain participants are determined by an earnings-based formula.

We also sponsor postretirement medical plans in the U.S. that provide health care benefits to our retirees

who meet certain eligibility requirements and who are not otherwise covered by multi-employer plans. Generally,

this includes employees with at least 10 years of service who have reached age 55 and employees who are

eligible for postretirement medical benefits from a Company-sponsored plan pursuant to their domestic

subsidiary company or collective bargaining agreements. We have the right to modify or terminate certain of

these plans. These benefits have been provided to certain retirees on a noncontributory basis; however, in many

cases, retirees are required to contribute all or a portion of the total cost of the coverage.

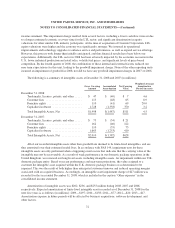

Our national master agreement with the International Brotherhood of Teamsters (“Teamsters”) allowed us,

upon ratification, to withdraw employees from the Central States, Southeast and Southwest Areas Pension Fund

(“Central States Pension Fund”), a multi-employer pension plan, and to establish a jointly trusteed single-

employer plan (“UPS IBT Pension Plan”) for this group of employees. We recorded a pre-tax charge of $6.100

billion to establish our withdrawal liability upon ratification of the national master agreement, and made a $6.100

billion payment to the Central States Pension Fund in December 2007. In connection with the national master

agreement and upon establishment of the UPS IBT Pension Plan, we restored certain benefit levels to our

employee group within the new plan, which resulted in the initial recognition of a $1.701 billion pension liability

and a corresponding $1.062 billion reduction of AOCI and $639 million reduction of long-term deferred tax

liabilities.

The withdrawal liability was based on computations performed by independent actuaries employed by the

Central States Pension Fund, in accordance with the plan document and the applicable requirements of the

Employee Retirement Income Security Act of 1974 (“ERISA”). We negotiated our withdrawal from the Central

States Pension Fund as part of our national master agreement with the Teamsters, which included other

modifications to hourly wage rates, healthcare and pension benefits, and work rules. We sought to negotiate our

withdrawal from the Central States Pension Fund, as we believed the fund would likely continue to have funding

challenges, and would present a risk to UPS of having to face higher future contribution requirements and a risk

to the security of the pension benefits of those UPS employees who participated in the fund. We believe that we

benefited financially from the ability to achieve a ratified national master agreement seven months before the

expiration of the previous agreement, as well as by gaining better control over the future cost and funding of

pension benefits by limiting our obligations solely to UPS Teamster employees through the new UPS IBT

Pension Plan. As the UPS IBT Pension Plan matures, we believe that it will become cost beneficial from a cash

flow and earnings standpoint compared with having remained in the Central States Pension Fund.

In September 2006, the FASB issued Statement No. 158 “Employers’ Accounting for Defined Benefit

Pension and Other Postretirement Plans (an amendment of FASB Statements No. 87, 88, 106, and 132(R))”

(“FAS 158”). This statement requires us to recognize the funded status of defined benefit pension and other

postretirement plans as an asset or liability in the balance sheet, and required delayed recognition items,

64