UPS 2008 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2008 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

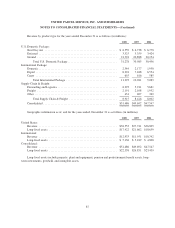

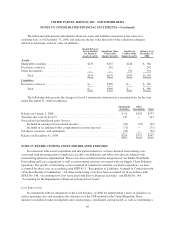

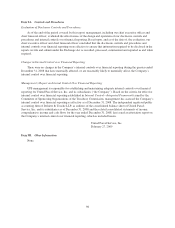

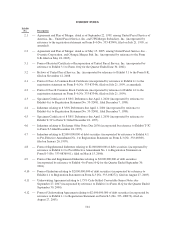

The following table presents information about our assets and liabilities measured at fair value on a

recurring basis as of December 31, 2008, and indicates the fair value hierarchy of the valuation techniques

utilized to determine such fair value (in millions).

Quoted Prices in

Active Markets

for Identical

Assets (Level 1)

Significant Other

Observable

Inputs (Level 2)

Significant

Unobservable

Inputs (Level 3)

Balance as of

December 31,

2008

Assets

Marketable securities ...................... $133 $437 $216 $ 786

Derivative contracts ....................... — 242 — 242

Other investments ......................... — — 331 331

Total ............................... $133 $679 $547 $1,359

Liabilities

Derivative contracts ....................... $— $389 $— $ 389

Total ............................... $— $389 $— $ 389

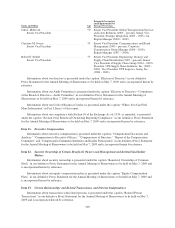

The following table presents the changes in Level 3 instruments measured on a recurring basis for the year

ended December 31, 2008 (in millions).

Marketable

Securities

Other

Investments Total

Balance on January 1, 2008 .......................................... $ 10 $363 $373

Transfers into (out of) Level 3 ........................................ 347 — 347

Net realized and unrealized gains (losses):

Included in earnings (in investment income) ......................... (20) (32) (52)

Included in accumulated other comprehensive income (pre-tax) .......... (71) — (71)

Purchases, issuances, and settlements .................................. (50) — (50)

Balance on December 31, 2008 ....................................... $216 $331 $547

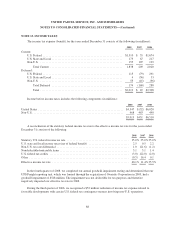

NOTE 17. RESTRUCTURING COSTS AND RELATED EXPENSES

In connection with recent acquisitions and integration initiatives, we have incurred restructuring costs

associated with the termination of employees, facility consolidations and other costs directly related to the

restructuring initiatives implemented. These costs have resulted from the integration of our Menlo Worldwide

Forwarding and Lynx acquisitions as well as restructuring activities associated with our Supply Chain Solutions

operations. For specific restructuring costs recognized in conjunction with the cost from acquisitions, we have

accounted for these costs in accordance with EITF 95-3, “Recognition of Liabilities Assumed in Connection with

a Purchase Business Combination.” All other restructuring costs have been accounted for in accordance with

SFAS No. 146, “Accounting for Costs Associated with Exit or Disposal Activities” and SFAS No. 144,

“Accounting for the Impairment or Disposal of Long-Lived Assets.”

Lynx Express Ltd.

In conjunction with our integration of the Lynx business, in 2006 we implemented a series of initiatives to

reduce operating costs and maximize the efficiencies of the UPS network in the United Kingdom. These

initiatives included closing existing hubs and constructing a consolidated sorting facility as well as establishing a

95