UPS 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

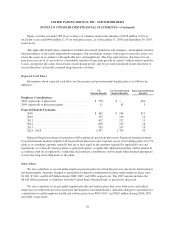

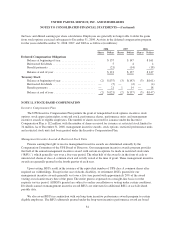

We also sponsor several defined contribution plans for all employees not covered under collective

bargaining agreements, and for certain employees covered under collective bargaining agreements. The

Company matches, in shares of UPS common stock or cash, a portion of the participating employees’

contributions. Matching contributions charged to expense were $116, $128, and $113 million for 2008, 2007, and

2006, respectively. In early 2009, we suspended the company matching contributions to the primary employee

defined contribution plan.

Contributions are also made to defined contribution money purchase plans under certain collective

bargaining agreements. Amounts charged to expense were $78, $72, and $62 million for 2008, 2007, and 2006,

respectively.

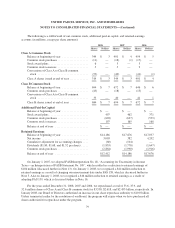

NOTE 6. GOODWILL AND INTANGIBLE ASSETS

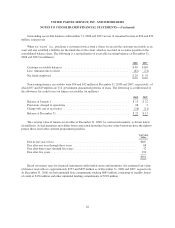

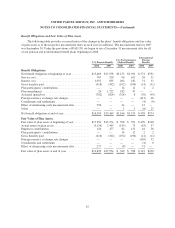

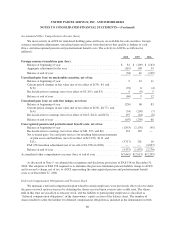

The following table indicates the allocation of goodwill by reportable segment (in millions):

U.S. Domestic

Package

International

Package

Supply Chain &

Freight Consolidated

December 31, 2006 balance ...................... $— $290 $2,243 $2,533

Acquired ................................. — — 2 2

Currency / Other .......................... — 5 37 42

December 31, 2007 balance ...................... — $295 $2,282 $2,577

Acquired ................................. — 4 — 4

Impairments .............................. — — (548) (548)

Currency / Other .......................... — (11) (36) (47)

December 31, 2008 balance ...................... $— $288 $1,698 $1,986

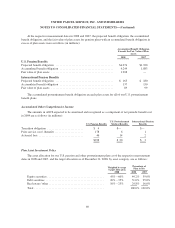

The goodwill acquired in the International Package segment during 2008 was due to our purchase of a

package delivery company in Romania and our buyout of a joint venture in Korea. The operating results of these

acquired businesses are not material to the International Package segment. The currency / other balance includes

the translation effect on goodwill from fluctuations in currency exchange rates, as well as escrow reimbursements

and the resolution of certain tax contingencies from acquisitions completed previously.

We test our goodwill for impairment annually, as of October 1st, on a reporting unit basis in accordance with

FAS 142. Our reporting units are comprised of the Europe, Asia, and Americas reporting units in the

International Package reporting segment, and the Forwarding & Logistics, UPS Freight, MBE / UPS Store, and

UPS Capital reporting units in the Supply Chain & Freight reporting segment. The impairment test involves a

two-step process. First, a comparison of the fair value of the applicable reporting unit with the aggregate carrying

values, including goodwill, is performed. We primarily determine the fair value of our reporting units using a

discounted cash flow model, and supplement this with observable valuation multiples for comparable companies,

as applicable. If the carrying amount of a reporting unit exceeds the reporting unit’s fair value, we perform the

second step of the goodwill impairment test to determine the amount of impairment loss. The second step

includes comparing the implied fair value of the affected reporting unit’s goodwill with the carrying value of that

goodwill.

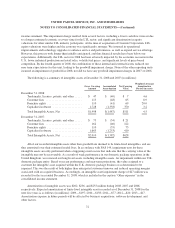

In the fourth quarter of 2008, we completed our annual goodwill impairment testing and determined that our

UPS Freight reporting unit, which was formed through the acquisition of Overnite Corporation in 2005, had a

goodwill impairment of $548 million which is included in the caption “other expenses” in the consolidated

71