UPS 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

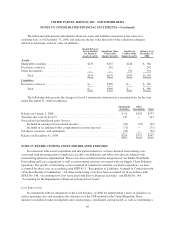

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

derivative financial instruments only to the extent necessary to manage exposures. As we use price sensitive

instruments to hedge a certain portion of our existing and anticipated transactions, we expect that any loss in

value for those instruments generally would be offset by increases in the value of those hedged transactions.

We do not hold or issue derivative financial instruments for trading or speculative purposes.

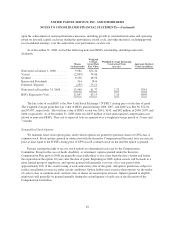

Commodity Price Risk Management

We are exposed to changes in the prices of refined fuels, principally jet-A, diesel, and unleaded gasoline.

Currently, the fuel surcharges that we apply to our domestic and international package and LTL services are the

primary means of reducing the risk of adverse fuel price changes. Additionally, we use a combination of options

contracts to provide partial protection from changing fuel and energy prices. The net fair value of such contracts

subject to price risk, excluding the underlying exposures, as of December 31, 2008 and 2007 was an asset

(liability) of $0 and $(179) million, respectively. We have designated and account for these contracts as cash

flow hedges, and to the extent the hedges remain effective, the resulting gains and losses from these hedges are

recognized in the income statement when the underlying fuel or energy product being hedged is consumed.

In the fourth quarter of 2008, we terminated several energy derivatives and received $87 million in cash.

Additionally, in the second quarter of 2006, we terminated several energy derivatives and received $229 million

in cash. These transactions are reported in “other investing activities” in the statement of cash flows. As these

derivatives qualified for hedge accounting, were designated as hedges, and maintained their effectiveness, the

gains associated with these hedges were recognized in income over the original term of the hedges. The hedges

that were terminated in the fourth quarter of 2008 will be recognized in the income statement through the first

quarter of 2009.

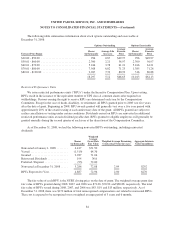

Foreign Currency Exchange Risk Management

We have foreign currency risks related to our revenue, operating expenses, and financing transactions in

currencies other than the local currencies in which we operate. We are exposed to currency risk from the

potential changes in functional currency values of our foreign currency denominated assets, liabilities, and cash

flows. Our most significant foreign currency exposures relate to the Euro, the British Pound Sterling, and the

Canadian Dollar. We use a combination of purchased and written options and forward contracts to hedge

currency cash flow exposures. As of December 31, 2008 and 2007, the net fair value of the hedging instruments

described above was an asset (liability) of $241 and $(42) million, respectively. We have designated and account

for these contracts as cash flow hedges of anticipated foreign currency denominated revenue and, therefore, the

resulting gains and losses from these hedges are recognized as a component of international package revenue

when the underlying sales occur.

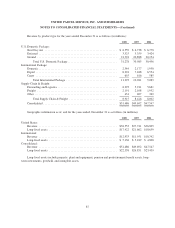

Interest Rate Risk Management

Our indebtedness under our various financing arrangements creates interest rate risk. We use a combination

of derivative instruments, including interest rate swaps and cross-currency interest rate swaps, as part of our

program to manage the fixed and floating interest rate mix of our total debt portfolio and related overall cost of

borrowing. These swaps are entered into concurrently with the issuance of the debt that they are intended to

modify, and the notional amount, interest payment, and maturity dates of the swaps match the terms of the

associated debt. We also utilize forward starting swaps and similar instruments to lock in all or a portion of the

borrowing cost of anticipated debt issuances.

92