UPS 2008 Annual Report Download - page 34

Download and view the complete annual report

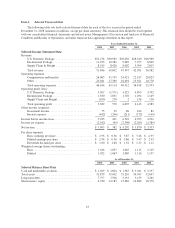

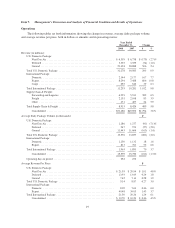

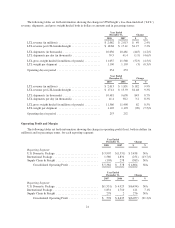

Please find page 34 of the 2008 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Areas Pension Fund (“Central States Pension Fund”), an aircraft impairment and a Special Voluntary Separation

Opportunity (“SVSO”) charge (all discussed further in the “Operating Expenses” section), which reduced

domestic operating profit by $6.100 billion, $159 million and $53 million, respectively. The absence of these

charges in 2008 favorably affected the operating profit comparison between periods.

Operating profit in 2008 was adversely impacted by the current U.S. recession, lower asset utilization due to

the decline in volume, lower average package weights, and a shift in product mix away from our premium

services, partially offset by the increase in the fuel surcharge relative to the cost of fuel. Because fuel costs

decreased rapidly in the latter half of the year, operating profit benefited from the approximate two month time

lag between the fuel price changes and when the monthly surcharge rates are applied to package shipments.

Because of this time lag, fuel positively impacted the change in operating profit during 2008, which is opposite

of the effect the company experienced in 2007, when fuel costs rose much faster than the fuel surcharge rate and

operating profit was adversely impacted.

2007 compared to 2006

U.S. Domestic Package revenue increased $529 million, or 1.7%, in 2007, due to a 1.6% improvement in

revenue per piece and a 0.4% increase in average daily package volume. Next Day Air volume increased 0.8%

and Ground volume increased 0.6% for the year, largely as a result of a solid peak season in the fourth quarter,

when our Next Day Air volume rose 2.2% and Ground volume increased 1.5%. Deferred air volume declined

1.9% in 2007. Our domestic air and ground products have been impacted by the slowing U.S. economy and weak

small package market in 2007. Trends in U.S. industrial production and business-to-consumer shipments in 2007

were not favorable to the overall small package market, which places pressure on our domestic package volume.

The increase in overall revenue per piece of 1.6% in 2007 resulted primarily from a rate increase that took

effect earlier in the year, but was negatively impacted by lower fuel surcharge revenue and an unfavorable shift

in product mix. Next Day Air revenue per piece declined 0.9%, and was negatively impacted by strong growth in

our lower-yielding Next Day Air Saver products. Deferred revenue per piece increased only 0.4%. The change in

revenue per piece for all our air products was negatively impacted by a lower fuel surcharge rate (discussed

further below). Ground revenue per piece increased 2.9%, primarily due to the rate increase, but was also

impacted slightly by a higher fuel surcharge due to higher diesel fuel prices in 2007 compared with 2006. Overall

product mix reduced revenue per piece, as our premium air products suffered volume declines while our ground

volume grew 0.6%.

Consistent with the practice in previous years, a rate increase took effect on January 1, 2007. We increased

the base rates 6.9% on UPS Next Day Air, UPS 2nd Day Air, and UPS 3 Day Select, and 4.9% on UPS Ground.

Other pricing changes included a $0.10 increase in the residential surcharge, and a $0.75 increase in the charge

for undeliverable packages after three delivery attempts.

In January 2007, we modified the fuel surcharge on domestic air services by reducing the index used to

determine the fuel surcharge by 2%. This fuel surcharge continued to be based on the U.S. Energy Department’s

Gulf Coast spot price for a gallon of kerosene-type jet fuel. Based on published rates, the average fuel surcharge

on domestic air products was 12.17% in 2007, a decline from the 14.02% in 2006, primarily due to the 2%

reduction in the index. The ground fuel surcharge rate continued to fluctuate based on the U.S. Energy

Department’s On-Highway Diesel Fuel Price. Based on published rates, the average fuel surcharge on domestic

ground products was 4.30% in 2007, an increase from 4.13% in 2006, due to higher diesel fuel prices. As a result

of the air products index rate reduction and fuel market price movements, total domestic fuel surcharge revenue

decreased by $110 million in 2007.

U.S. Domestic Package incurred an operating loss of $1.531 billion in 2007, compared with a $4.923 billion

operating profit in 2006, largely due to a $6.100 billion charge related to our withdrawal from the Central States

Pension Fund. Additionally, Domestic Package operating results were negatively impacted by low revenue

23