UPS 2008 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2008 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Other Debt:

The other debt balance primarily relates to loans entered into in conjunction with our investment in various

partnerships. Substantially all of this debt is classified as a current liability. The implied interest rates on this debt

range from 3.20% to 6.43%.

Other Information

Based on the borrowing rates currently available to the Company for long-term debt with similar terms and

maturities, the fair value of long-term debt, including current maturities, is approximately $10.287 and $11.238

billion as of December 31, 2008 and 2007, respectively.

We lease certain aircraft, facilities, equipment and vehicles under operating leases, which expire at various

dates through 2055. Certain of the leases contain escalation clauses and renewal or purchase options. Rent

expense related to our operating leases was $834, $896, and $912 million for 2008, 2007, and 2006, respectively.

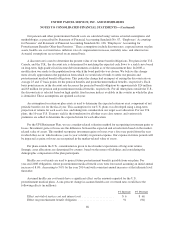

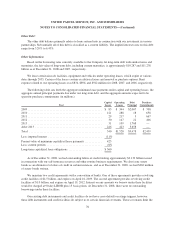

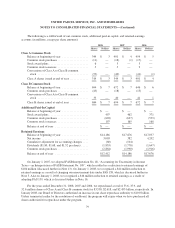

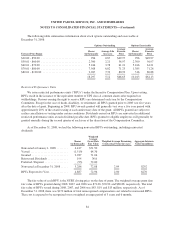

The following table sets forth the aggregate minimum lease payments under capital and operating leases, the

aggregate annual principal payments due under our long-term debt, and the aggregate amounts expected to be

spent for purchase commitments (in millions).

Year

Capital

Leases

Operating

Leases

Debt

Principal

Purchase

Commitments

2009 ................................................... $ 83 $ 344 $2,007 $ 708

2010 ................................................... 121 288 18 658

2011 ................................................... 29 217 5 667

2012 ................................................... 30 147 22 406

2013 ................................................... 31 109 1,768 —

After 2013 .............................................. 246 423 5,658 —

Total .................................................. 540 $1,528 $9,478 $2,439

Less: imputed interest ..................................... (115)

Present value of minimum capitalized lease payments ............ 425

Less: current portion ...................................... (65)

Long-term capitalized lease obligations ....................... $360

As of December 31, 2008, we had outstanding letters of credit totaling approximately $2.132 billion issued

in connection with our self-insurance reserves and other routine business requirements. We also issue surety

bonds as an alternative to letters of credit in certain instances, and as of December 31, 2008, we had $262 million

of surety bonds written.

We maintain two credit agreements with a consortium of banks. One of these agreements provides revolving

credit facilities of $4.5 billion, and expires on April 16, 2009. The second agreement provides revolving credit

facilities of $1.0 billion, and expires on April 19, 2012. Interest on any amounts we borrow under these facilities

would be charged at 90-day LIBOR plus 15 basis points. At December 31, 2008, there were no outstanding

borrowings under these facilities.

Our existing debt instruments and credit facilities do not have cross-default or ratings triggers, however

these debt instruments and credit facilities do subject us to certain financial covenants. These covenants limit the

76