Tyson Foods 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Ty s on Foods, Inc. 2006 Annual Report61

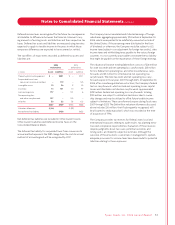

Eleven-Year Financial Summary

2002 2001 2000 1999 1998 1997 1996

$23,367 $10,563 $7,268 $7,621 $7,414 $6,356 $6,454

21,550 9,660 6,453 6,470 6,260 5,318 5,506

1,817 903 815 1,151 1,154 1,038 948

887 316 349 487 204 400 269

305 144 116 124 139 110 133

210 58 83 129 46 144 49

–––––––

$ 383 $ 88 $ 151 $ 230 $ 25 $ 186 $ 87

353 349 225 229 231 213 217

355 222 226 231 228 218 218

$ – $ – $ – $ – $ – $ – $ –

–––––––

–––––––

1.08 0.40 0.67 1.00 0.11 0.85 0.40

1.13 0.42 0.70 1.05 0.12 0.90 0.42

1.02 0.38 0.63 0.94 0.10 0.81 0.38

0.160 0.160 0.160 0.115 0.100 0.095 0.080

0.144 0.144 0.144 0.104 0.090 0.086 0.072

$ 467 $ 335 $ 294 $ 291 $ 276 $ 230 $ 239

$ 433 $ 261 $ 196 $ 363 $ 310 $ 291 $ 214

10,372 10,632 4,841 5,083 5,242 4,411 4,544

4,038 4,085 2,141 2,185 2,257 1,925 1,869

3,987 4,776 1,542 1,804 2,129 1,690 1,975

$3,662 $3,354 $2,175 $2,128 $1,970 $1,621 $1,542

1.6% 0.8% 2.0% 3.0% 0.3% 2.9% 1.4%

121.2% 45.3% (4.6)% 2.8% 16.7% (1.5)% 17.1%

7.8% 8.5% 11.2% 15.1% 15.6% 16.3% 14.7%

11.4% 4.0% 7.1% 11.7% 1.5% 12.1% 5.9%

11.2% 5.3% 9.1% 12.1% 5.5% 11.7% 7.7%

35.5% 35.4% 35.6% 34.9% 64.7% 43.6% 37.0%

52.1% 58.7% 41.5% 45.9% 51.9% 51.0% 56.2%

$10.37 $9.61 $9.67 $9.31 $8.53 $7.60 $7.09

15.56 14.19 18.00 25.38 24.44 23.63 18.58

$8.75 $8.35 $8.56 $15.00 $16.50 $17.75 $13.83

8. The results for fiscal 2001 include $26 million of pretax charges for expenses related to the TFM acquisition, loss on sale of swine assets and product recall losses.

9. The results for fiscal 2000 include a $24 million pretax charge for a bad debt write-off related to the January 2000 bankruptcy filing of AmeriServe Food Distribution, Inc. and a

$9 million pretax charge related to Tyson de Mexico losses.

10. Certain costs for fiscal years 1999 and prior have not been reclassified as the result of the application of Emerging Issues Task Force Issue No. 00-14, “Accounting for Certain

Sales Incentives” and Emerging Issues Task Force Issue No. 00-25, “Vendor Income Statement Characterization of Consideration Paid to a Reseller of the Vendor’s Products.”

11. The results for fiscal 1999 include a $77 million pretax charge for loss on sale of assets and impairment write-downs.

12. Significant business combinations accounted for as purchases: TFM and Hudson Foods, Inc. in 2001 and 1998, respectively.

13. The results for fiscal 1998 include a $215 million pretax charge for asset impairment and other charges.

14. The results for fiscal 1997 include a $41 million pretax gain from the sale of the beef division assets.

15. Return on beginning shareholders’ equity is calculated by dividing net income (loss) by beginning shareholders’ equity.

16. Return on invested capital is calculated by dividing operating income (loss) by the sum of the average of beginning and ending total debt and shareholders’ equity.

17. The 2006 Total debt to capitalization ratio is not adjusted for the $750 million short-term investment the Company had on deposit at September 30, 2006.