Tyson Foods 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Deferred income taxes are recognized for the future tax consequences

attributable to differences between the financial statement carry-

ing amounts of existing assets and liabilities and their respective tax

bases. Deferred tax assets and liabilities are measured using tax rates

expected to apply to taxable income in the years in which those

temporary differences are expected to be recovered or settled.

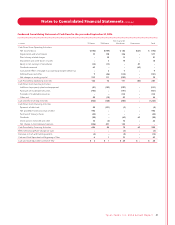

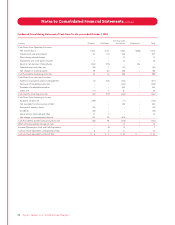

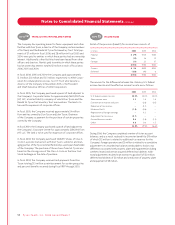

The tax effects of major items recorded as deferred tax assets and

liabilities are:

2006 2005

Deferred Tax Deferred Tax

in millions Assets Liabilities Assets Liabilities

Property, plant and equipment $ – $481 $ – $511

Suspended taxes from

conversion to accrual method –119 – 125

Intangible assets 10 26 9 25

Inventory13 101 10 97

Accrued expenses 177 –131 6

Net operating loss

and other carryforwards 137 –125 –

All other 50 22 58 122

$387 $749 $ 333 $886

Valuation allowance $ (66) $(99)

Net deferred tax liability $428 $652

Net deferred tax liabilities are included in Other Current Assets,

Other Current Liabilities and Deferred Income Taxes on the

Consolidated Balance Sheets.

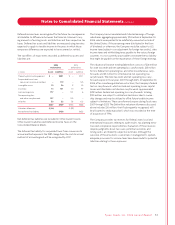

The deferred tax liability for suspended taxes from conversion to

accrual method represents the 1987 change from the cash to accrual

method of accounting and will be recognized by 2017.

The Company has accumulated undistributed earnings of foreign

subsidiaries aggregating approximately $153 million at September 30,

2006, which are expected to be indefinitely reinvested outside of

the United States. If those earnings were distributed in the form

of dividends or otherwise, the Company would be subject to U.S.

income taxes (subject to an adjustment for foreign tax credits), state

income taxes and withholding taxes payable to the various foreign

countries. It is not currently practicable to estimate the tax liability

that might be payable on the repatriation of these foreign earnings.

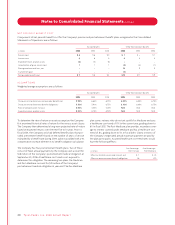

The valuation allowance totaling $66 million consists of $26 million

for state tax credit and net operating loss carryforwards, $35 million

for U.S. federal net operating loss and other miscellaneous carry-

forwards and $5 million for international net operating loss

carryforwards. The state tax credit and net operating loss carry-

forwards expire in fiscal years 2007 through 2025. At September 30,

2006, after considering utilization restrictions, the Company’s federal

tax loss carryforwards, which include net operating losses, capital

losses and charitable contribution carryforwards, approximated

$259 million. Federal net operating loss carryforwards totaling

$120 million, are subject to utilization limitations due to owner-

ship changes and may be utilized to offset future taxable income

subject to limitations. Thesecarryforwards expire during fiscal years

2007 through 2025. The $66 million valuation allowance discussed

above includes $30 million, that if subsequently recognized, will

be allocated to reduce goodwill, which was recorded at the time

of acquisition of TFM.

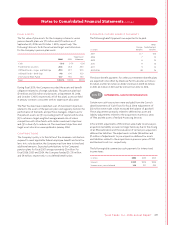

The Company provides tax reserves for federal, state, local and

international exposures relating to audit results, tax planning initia-

tives and compliance responsibilities. Evaluation of these reserves

requires judgments about tax issues, potential outcomes and

timing, and is an inherently subjective estimate. Although the

outcome of these tax items is uncertain, in management’s opinion,

adequate provisions for income taxes have been made for potential

liabilities relating to these exposures.

Ty s on Foods, Inc. 2006 Annual Report51

Notes to Consolidated Financial Statements continued