Tyson Foods 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Prepared Foods segment includes the Company’s operations

that manufacture and market frozen and refrigerated food prod-

ucts. Products include pepperoni, beef and pork pizza toppings,

pizza crusts, flour and corn tortilla products, appetizers, prepared

meals, ethnic foods, soups, sauces, side dishes, meat dishes and

processed meats. The Prepared Foods segment markets its products

domestically to food retailers, foodservice distributors, restaurant

operators and noncommercial foodservice establishments such

as schools, hotel chains, healthcare facilities, the military and

other food processors, as well as to international markets

throughout the world.

• Other segment includes the logistics group and other miscella-

neous operations.

Ty s on Foods, Inc. 2006 Annual Report53

Notes to Consolidated Financial Statements continued

Prepared

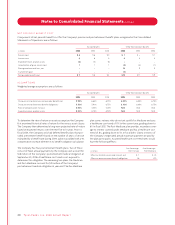

in millions Chicken Beef Pork Foods Other Consolidated

Fiscal year ended September 30, 2006

Sales $7,928 $11,825 $3,060 $2,692 $54 $25,559

Operating income (loss) 53 (296) 47 45 74 (77)

Other expense 216

Loss before income taxes (293)

Income tax benefit (102)

Loss before cumulative effect of change in accounting principle (191)

Cumulative effect of change in accounting principle, net of tax 5

Depreciation 222 106 30 60 63 481

Total assets 4,325 3,271 833 1,006 1,686 11,121

Additions to property, plant and equipment 219 135 13 54 110 531

Fiscal year ended October 1, 2005

Sales $8,295 $11,618 $3,247 $2,801 $ 53 $ 26,014

Operating income (loss) 582 (12) 47 78 50 745

Other expense 217

Income before income taxes 528

Depreciation 241 111 31 65 17 465

Total assets 4,398 3,243 834 1,107 922 10,504

Additions to property, plant and equipment 321 165 23 55 7 571

Fiscal year ended October 2, 2004

Sales $8,363 $11,951 $3,185 $2,891 $ 51 $ 26,441

Operating income 548 127 140 28 74 917

Other expense 282

Income before income taxes 635

Depreciation 239 106 30 66 17 458

Total assets 4,556 3,195 895 970 848 10,464

Additions to property, plant and equipment 298 90 22 61 15 486

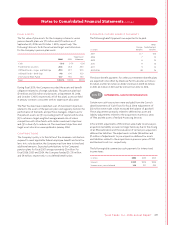

The Pork segment had sales of $467 million, $505 million and

$473 million for fiscal years 2006, 2005 and 2004, respectively,

from transactions with other operating segments of the Company.

The Beef segment had sales of $104 million, $85 million and

$75 million for fiscal years 2006, 2005 and 2004, respectively, from

transactions with other operating segments of the Company. These

sales from intersegment transactions, which are sold at market

prices, were excluded from the segment sales in the above table.

The Company’s largest customer, Wal-Mart Stores, Inc., accounted

for approximately 12.5%, 13.0% and 11.6% of consolidated sales in

fiscal years 2006, 2005 and 2004, respectively. Sales to Wal-Mart

Stores, Inc. were included in the Chicken, Beef, Pork and Prepared

Foods segments. Any extended discontinuance of sales to this

customer could, if not replaced, have a material impact on the

Company’s operations; however, the Company does not anticipate

any such occurrences.