Tyson Foods 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTE 14 TRANSACTIONS WITH RELATED PARTIES

The Company has operating leases for farms, equipment and other

facilities with Don Tyson, a director of the Company, certain members

of his family and the Randal W. Tyson Testamentary Trust. Total pay-

ments of $7 million in fiscal 2006, and $8 million in fiscal 2005 and

2004, were paid to entities in which these parties had an ownership

interest. Additionally, other facilities have been leased from other

officers and directors. Rentals paid to entities in which these parties

had an ownership interest totaled $1 million in each of fiscal years

2006, 2005 and 2004.

In fiscal 2006, 2005 and 2004, the Company paid approximately

$1.3 million, $1.3 million and $1.5 million, respectively, to Alltel Corpo-

ration for cellular phone services. Scott T. Ford, who became a

director of the Company in November 2005, is the President

and Chief Executive Officer of Alltel Corporation.

In fiscal 2005, the Company purchased a parcel of land adjacent to

the Company’s Corporate Center for approximately $600,000 from

JHT, LLC, a limited liability company of which Don Tyson and the

Randal W. Tyson Testamentary Trust are members. The land is to

be used for expansion of corporate offices.

In fiscal 2005, the Company received approximately $4 million

from entities owned by Don Tyson and John Tyson, Chairman

of the Company, as payment for the purchase of certain properties

owned by the Company.

In fiscal 2004, the Company purchased a parcel of land adjacent to

the Company’s Corporate Center for approximately $356,000 from

JHT, LLC. The land is to be used for expansion of corporate offices.

In fiscal 2004, the Company purchased 1,028,577 shares of Class A

stock in a private transaction with Don Tyson, a director and man-

aging partner of the Tyson Limited Partnership, a principal shareholder

of the Company. The purchase of those shares from Mr. Tyson was

based on the closing price of the Class A stock on the New York

Stock Exchange on the date of purchase.

In fiscal 2004, the Company received cash payments from Don

Tyson totaling $1.5 million as reimbursement for certain perquisites

and personal benefits received during fiscal 1997 through 2003.

NOTE 15 INCOME TAXES

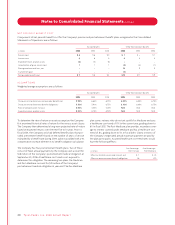

Detail of the provision (benefit) for income taxes consists of:

in millions 2006 2005 2004

Federal $ (79) $118 $183

State (12) 16 12

Foreign (11) 22 37

$(102) $156 $232

Current $ 24 $249 $224

Deferred (126) (93) 8

$(102) $156 $232

The reasons for the difference between the statutory U.S. federal

income tax rate and the effective income tax rate are as follows:

2006 2005 2004

U.S. federal income tax rate 35.0% 35.0% 35.0%

State income taxes 3.3 1.8 1.8

Extraterritorial income exclusion –(2.6) (0.5)

Reduction of tax reserves –(4.1) –

Medicare Part D (1.8) (3.6) –

Repatriation of foreign earnings –4.2 –

Adjustment for tax review (5.1) – –

General business credits 2.6 (1.8) (1.2)

Other 0.8 0.6 1.5

34.8% 29.5% 36.6%

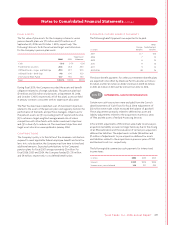

During 2006, the Company completed a review of its tax account

balances, and as a result, reduced its income tax benefit by $15 million

of which $12 million is related to additional tax reserves for the

Company’s foreign operations and $3 million is related to a cumulative

adjustment to its recorded tax balances attributable to book to tax

differences associated with property, plant and equipment (including

synthetic leases) and certain acquired deferred tax liabilities. Addi-

tional adjustments resulted in an increase to goodwill of $12 million,

deferred tax liabilities of $3 million and a reduction of property, plant

and equipment of $9 million.

50 Ty s o n F o o d s , I n c . 2 0 0 6 A n n u a l R e p o r t

Notes to Consolidated Financial Statements continued