Tyson Foods 2006 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2006 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On September 18, 2006, TFM, a wholly-owned subsidiary of the

Company, guaranteed the 2016 Notes. This guarantee does not

extend to the other unsecured senior notes of the Company.

Moody’s and S&P did not change the July 2006 credit ratings appli-

cable to the 2016 Notes. However, Moody’s issued a new credit

rating of “Ba2,” and S&P issued a new credit rating of “BB+” related

to the other unsecured senior notes not guaranteed by TFM. These

new ratings did not impact the interest rate applicable to the 2016

Notes. However, other interest expense and related fees for other

debt increased by less than $3 million.

The revolving credit facility, senior notes, term loan and accounts

receivable securitization contain various covenants, the more restric-

tive of which contain maximum allowed leverage ratios and a mini-

mum required interest coverage ratio.

On July 27, 2006, the Company entered into a third amendment to

its five-year credit revolving facility and the three-year term loan

facility of its subsidiary, Lakeside Farm Industries, Ltd. These amend-

ments modified the minimum required interest coverage ratio,

temporarily suspended the maximum allowed leverage ratios and

implemented temporary minimum consolidated EBITDA require-

ments. The Company was in compliance with all of such covenants

at fiscal year end.

In connection with these amendments, the Company’s availability

under its unsecured revolving credit facility decreased, and if the

Company’s credit rating is further downgraded, prior to the delivery

of the second quarter fiscal 2007 compliance certificate, the Company

is required to have certain subsidiaries guarantee the revolving

credit facility and term loan.

Long-term debt consists of the following:

in millions Maturity 2006 2005

Revolving credit facility 2010 $ – $ –

Senior notes (rates ranging from

6.13% to 8.25%) 2006–2028 3,388 2,529

Term loan (6.36% effective rate

at 9/30/06) 2008 345 345

Accounts receivable securitization

(5.98% effective rate at 9/30/06) 2007, 2009 159 –

Institutional notes –10

Leveraged equipment loans

(rates ranging from 4.67% to 5.36%) 2007–2009 38 64

Other Various 49 47

Total debt 3,979 2,995

Less current debt 992 126

Total long-term debt $2,987 $2,869

Under the terms of the leveraged equipment loans, the Company

had cash deposits totaling approximately $35 million and $52 million,

which were included on the Consolidated Balance Sheets in Other

Assets at September 30, 2006, and October 1, 2005. Under these

leveraged loan agreements, the Company entered into interest

rate swap agreements to effectively lock in a fixed interest rate

for these borrowings.

Annual maturities of long-term debt for the five fiscal years subsequent

to September 30, 2006, are: 2007 – $992 million; 2008 – $19 million;

2009 – $435 million; 2010 – $236 million; 2011 – $1 million.

The Company has fully and unconditionally guaranteed $375 million

of senior notes issued by TFM, a wholly-owned subsidiary of the

Company. Additionally, the Company has fully and unconditionally

guaranteed $345 million related to a term loan facility borrowed

by Lakeside Farm Industries, Ltd., a wholly-owned subsidiary of

the Company.

TFM, a wholly-owned subsidiary of the Company, has fully and

unconditionally guaranteed the Company’s 2016 Notes. The follow-

ing condensed consolidating financial information is

provided for

the Company, as issuer, and for TFM, as guarantor,

as an alternative

to providing separate financial statements for the guarantor.

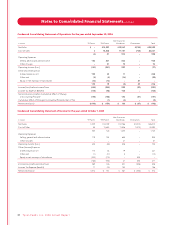

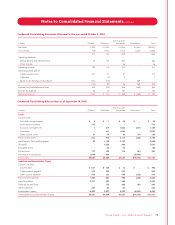

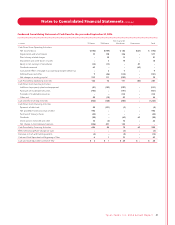

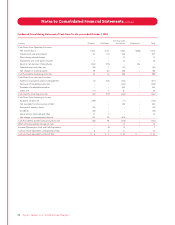

The following financial information presents condensed consolidat-

ing financial statements, which include Tyson Foods, Inc. (TFI Parent);

Tyson Fresh Meats, Inc. (TFM Parent); the Non-Guarantor Subsidiaries

on a combined basis; the elimination entries necessary to consoli-

date the TFI Parent, TFM Parent and the Non-Guarantor Subsidiaries;

and Tyson Foods, Inc. on a consolidated basis.

Ty s o n F o o d s , I n c . 2 0 0 6 A n n u a l R e p o r t 37

Notes to Consolidated Financial Statements continued