Tyson Foods 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

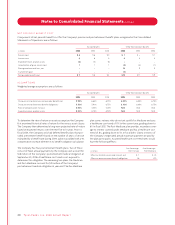

Second quarter fiscal 2006 operating income includes $45 million

of costs related to beef plant closings and $14 million related to

prepared foods plant closings. Fourth quarter fiscal 2006 operating

income includes $2 million of costs related to poultry plant closings,

$2 million of costs related to beef plant closings, and $19 million of

charges related to the Company’s previously announced $200 million

cost reduction initiative and other business consolidation efforts.

These charges include severance expenses, product rationalization

costs and related intangible asset impairment expenses. Additionally,

in the fourth quarter of fiscal 2006, the Company recorded a charge

of $5 million, net of tax, related to the cumulative effect of change

in accounting principle for the adoption of FIN 47.

First quarter fiscal 2005 gross profit includes $12 million received in

connection with vitamin antitrust litigation, and operating income

includes charges of $3 million related to the closing of a prepared

foods facility. Additionally, net income includes a gain of $8 million

related to the sale of the Company’s remaining interest in Specialty

Brands, Inc. Second quarter fiscal 2005 operating income includes

charges of $2 million related to closing poultry and prepared foods

facilities. Third quarter fiscal 2005 operating income includes charges

of $33 million related to a legal settlement involving the Company’s

live swine operations and $10 million related to closing poultry opera-

tions. Fourth quarter fiscal 2005 gross profit includes $8 million related

to hurricane losses, and operating income includes $1 million in gains

related to plant closings. Additionally, net income includes a non-

recurring income tax net benefit of $15 million, which includes

the reversal of tax reserves, partially offset by an income tax

charge related to the repatriation of foreign income. Net income

also was affected by $19 million related to a tax exempt actuarial

gain of $55 million.

During the second quarter of fiscal 2006, the Company reclassified

amounts related to loss on disposals of assets from other expense to

cost of sales. The reclassification reduced gross profit and operating

income (loss) by $4 million for the first quarter of fiscal 2006, and

$3 million, $8 million, $7 million and $2 million for the first, second,

third and fourth quarters of fiscal 2005, respectively. The table on

page 54 reflects this reclassification.

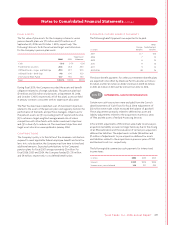

NOTE 19 CAPITAL STRUCTURE

During fiscal 2006, Tyson Limited Partnership converted 15 million

shares of Class B stock to Class A stock on a one for one basis.

Additionally, Don Tyson, a director of the Company, converted

750,000 shares of Class B stock to Class A stock on a one for

one basis.

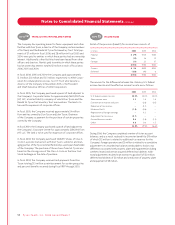

NOTE 20 CONTINGENCIES

Listed below are certain claims made against the Company and

its subsidiaries. In the Company’s opinion, it has made appropriate

and adequate reserves, accruals and disclosures where necessary,

and the Company believes the probability of a material loss beyond

the amounts accrued to be remote; however, the ultimate liability

for these matters is uncertain, and if accruals and reserves are not

adequate, an adverse outcome could have a material effect on

the consolidated financial condition or results of operations of the

Company. The Company believes it has substantial defenses to

the claims made and intends to vigorously defend these cases.

• Wage and Hour/Labor Matters: In 2000, the Wage and Hour

Division of the U.S. Department of Labor (DOL) conducted an

industry-wide investigation of poultry producers, including the

Company, to ascertain compliance with various wage and hour

issues. As part of this investigation, the DOL inspected 14 of the

Company’s processing facilities. On May 9, 2002, a civil complaint

was filed against the Company in the U.S. District Court for the

Northern District of Alabama, Elaine L. Chao, Secretary of Labor,

United States Department of Labor v. Tyson Foods, Inc.The com-

plaint alleges the Company violated the overtime provisions

of the federal Fair Labor Standards Act (FLSA) at the Company’s

chicken-processing facility in Blountsville, Alabama. The complaint

does not contain a definite statement of what acts constituted

alleged violations of the statute, although the Secretary of Labor

indicated in discovery the case seeks to require the Company to

compensate all hourly chicken processing workers for pre- and

post-shift clothes changing, washing and related activities and for

one of two unpaid 30-minute meal periods. The Secretary of Labor

seeks unspecified back wages for all employees at the Blountsville

facility for a period of two years prior to the date of the filing of

the complaint, an additional amount in unspecified liquidated

damages and an injunction against future violations at that facility

and all other chicken processing facilities operated by the

Company. No trial date has been set.

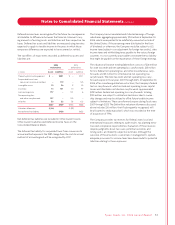

On June 22, 1999, 11 current and former employees of the Company

filed the case of M.H. Fox, et al. v. Tyson Foods, Inc. (Fox) in the

U.S. District Court for the Northern District of Alabama claiming

the Company violated requirements of the FLSA. The suit alleges

the Company failed to pay employees for all hours worked and/or

improperly paid them for overtime hours. The suit specifically

alleges that (1) employees should be paid for time taken to put on

and take off certain working supplies at the beginning and end of

their shifts and breaks and (2) the use of “mastercard” or “line” time

fails to pay employees for all time actually worked. Plaintiffs seek

to represent themselves and all similarly situated current and

Ty s on Foods, Inc. 2006 Annual Report55

Notes to Consolidated Financial Statements continued