Tyson Foods 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

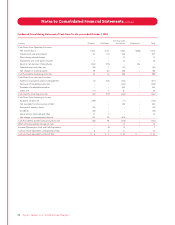

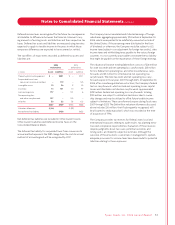

NOTE 16 EARNINGS (LOSS) PER SHARE

The weighted average common shares used in the computation of

basic and diluted earnings (loss) per share are as follows:

in millions, except per share data 2006 2005 2004

Numerator:

Income (loss) before cumulative effect

of change in accounting principle $ (191) $ 372 $ 403

Cumulative effect of change in

accounting principle, net of tax (5) – –

Net income (loss) (196) 372 403

Less Dividends:

Class A ($0.16/share) 41 40 40

Class B ($0.144/share) 14 15 15

Undistributed earnings (losses) (251) 317 348

Class A undistributed earnings (losses) (186) 230 253

Class B undistributed earnings (losses) (65) 87 95

Total undistributed earnings (losses) $ (251) $ 317 $ 348

Denominator:

Denominator for basic earnings per share:

Class A weighted average shares 249 243 243

Class B weighted average shares, and

shares under if-converted method for

diluted earnings per share 96 102 102

Effect of dilutive securities:

Stock options and restricted stock –12 12

Denominator for diluted earnings per

share – adjusted weighted average

shares and assumed conversions 345 357 357

Earnings before cumulative effect of

change in accounting principle:

Class A Basic $(0.56) $1.11 $1.20

Class B Basic $(0.52) $1.00 $1.08

Diluted $(0.56) $1.04 $1.13

Cumulative effect of change in

accounting principle, net of tax:

Class A Basic $(0.02) $ – $ –

Class B Basic $(0.01) $ – $ –

Diluted $(0.02) $ – $ –

Net income (loss):

Class A Basic $(0.58) $1.11 $1.20

Class B Basic $(0.53) $1.00 $1.08

Diluted $(0.58) $1.04 $1.13

Approximately 28 million in fiscal 2006 and two million in each

of fiscal 2005 and 2004 of the Company’s option shares were

antidilutive and were not included in the dilutive earnings

per share calculation.

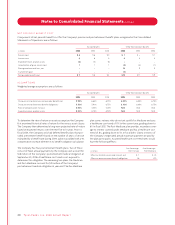

NOTE 17 SEGMENT REPORTING

The Company operates in five business segments: Chicken, Beef,

Pork, Prepared Foods and Other. The Company measures segment

profit as operating income.

• Chicken segment is involved primarily in processing live

chickens into fresh, frozen and value-added chicken products.

The Chicken segment markets its products domestically to food

retailers, foodservice distributors, restaurant operators and non-

commercial foodservice establishments such as schools, hotel

chains, healthcare facilities, the military and other food processors,

as well as to international markets throughout the world. The

Chicken segment also includes sales from allied products and

the Company’s chicken breeding stock subsidiary.

• Beef segment is involved primarily in processing live fed cattle

and fabricating dressed beef carcasses into primal and sub-primal

meat cuts and case-ready products. It also involves deriving value

from allied products such as hides and variety meats for sale to

further processors and others. The Beef segment markets its products

domestically to food retailers, foodservice distributors, restaurant

operators and noncommercial foodservice establishments such as

schools, hotel chains, healthcare facilities, the military and other

food processors, as well as to international markets throughout the

world. Allied products are also marketed to manufacturers of phar-

maceuticals and technical products.

• Pork segment is involved primarily in processing live market hogs

and fabricating pork carcasses into primal and sub-primal cuts and

case-ready products. This segment also represents the Company’s

live swine group and related allied product processing activities.

The Pork segment markets its products domestically to food

retailers, foodservice distributors, restaurant operators and non-

commercial foodservice establishments such as schools, hotel

chains, healthcare facilities, the military and other food processors,

as well as to international markets throughout the world. It also

sells allied products to pharmaceutical and technical products

manufacturers, as well as live swine to pork processors.

52 Ty s o n F o o d s , I n c . 2 0 0 6 A n n u a l R e p o r t

Notes to Consolidated Financial Statements continued