Tyson Foods 2006 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2006 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 Ty s on Foods, Inc. 2006 Annual Report

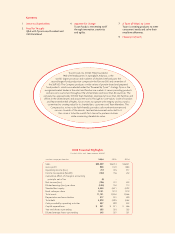

RESULTS OF OPERATIONS

OVERVIEW

Tyson Foods is the world’s largest meat protein company and the

second largest food production company in theFortune 500 with

one of the most recognized brand names in the food industry. Tyson

produces, distributes and markets chicken, beef, pork, prepared foods

and related allied products. The Company’s operations are conducted

in five segments: Chicken, Beef, Pork, Prepared Foods and Other.

Some of the key factors that influence the Company’s business are

customer demand for the Company’s products, the ability to main-

tain and grow relationships with customers and introduce new and

innovative products to the marketplace, accessibility of interna-

tional markets, market prices for the Company’s chicken, beef

and pork products, the cost of live cattle and hogs, raw materials

and grain and operating efficiencies of the Company’s facilities.

The Company faced very challenging operating conditions in

fiscal 2006. Demand pressures caused mainly by outbreaks of avian

influenza, primarily in Europe and Asia, Hurricane Katrina and other

export market disruptions in the Company’s Chicken and Beef

segments, led to an oversupply of proteins worldwide and negatively

affected the average sales prices and operating results of each of

the Company’s protein segments. Operations also were affected

negatively by higher energy costs, and significant operating margin

reductions at the Company’s operations in Canada and Mexico.

Net loss for fiscal 2006 was $196 million, or $0.58 per diluted share,

compared to earnings of $372 million, or $1.04 per diluted share, in

fiscal 2005. Pretax loss for fiscal 2006 includes $63 million of costs

related to beef, prepared foods and poultry plant closings and

$19 million of charges related to the Company’s $200 million cost

reduction initiative and other business consolidation efforts. These

charges include severance expenses, product rationalization costs

and related intangible asset impairment expenses. Additionally,

the Company completed a review of its tax account balances,

and as a result, recorded a charge in the fourth quarter of fiscal

2006 of approximately $15 million. Also, net loss for fiscal 2006

includes a charge of $5 million, or $0.02 per diluted share, related

to the cumulative effect of a change in accounting principle due

to the Company’s adoption of Financial Accounting Standards

Board (FASB) Interpretation No. 47, “Accounting for Conditional

Asset Retirement Obligations,” an interpretation of FASB Statement

No. 143. Combined, these items increased fiscal 2006 diluted loss

per share by $0.21.

Pretax earnings for fiscal 2005 include $33 million of costs related to

a legal settlement involving the Company’s live swine operations,

$14 million of costs for poultry and prepared foods plant closings,

$8 million of losses related to Hurricane Katrina, $12 million received

in connection with vitamin antitrust litigation and a gain of $8 mil-

lion from the sale of the Company’s remaining interest in Specialty

Brands, Inc. Net income in fiscal 2005 includes a non-recurring

income tax net benefit of $15 million. The net benefit includes the

reversal of tax reserves, partially offset by an income tax charge

related to the repatriation of foreign income. The effective tax rate

of the Company was affected further by the federal income tax

effect of the Medicare Part D subsidy in fiscal 2005 of $55 million

because this amount is not subject to federal income tax. Combined,

these items increased fiscal 2005 diluted earnings per share by $0.03.

The Company’s accounting cycle resulted in a 52-week year for

fiscal years 2006 and 2005, and a 53-week year for fiscal 2004.

OUTLOOK

Management’s primary goal during this difficult operating environ-

ment is to return the Company to profitability. One of the meas-

ures being taken to achieve this goal is to manage and reduce costs.

The Company initiated a $200 million cost reduction initiative in

the fourth quarter of fiscal 2006. Approximately 90% of the initia-

tive has been implemented, and the Company began realizing

savings in the first quarter of fiscal 2007.

Although returning the Company to profitability is its primary short-

term goal, management also remains focused on the following pri-

mary elements of its long-term strategy: creating more value-added

products, improving operational efficiencies and expanding inter-

nationally. During the year, the Company strongly examined its

business as well as various opportunities and took the necessary

steps to better position itself to meet its long-term goals. The

Company’s Discovery Center is nearing completion and should be

operational in the second quarter of fiscal 2007. The Discovery

Center is expected to bring new market-leading retail and food-

service products to the customer faster and more effectively. It

is a state-of-the-art facility, which includes 19 research centers as

well as a USDA-inspected pilot plant. In fiscal 2006, the Company

announced the rationalization of three beef plants and two pre-

pared foods plants. Additionally, the Company completed several

major capital projects in fiscal 2006, including a case-ready plant

in Sherman, Texas, and an expansion at the Dakota City, Nebraska,

location. The Company realized certain operational efficiencies in

fiscal 2006 related to its rationalization and expansion efforts and

expects continued efficiencies in fiscal 2007. In November 2006, the

Company announced a new business unit, Tyson Renewable Energy,

which has been exploring ways to commercialize the Company’s

supply of animal fat into bio-fuels. The new unit also is examining

the potential use of poultry litter to generate energy and other

products. With regard to the Company’s international expansion

goals, the Company expects to close on a transaction during fiscal

2007, which would establish a joint venture with a poultry company

in China. Additionally, the Company expects to complete two joint

venture transactions in South America in 2007; one involving a

poultry operation in Brazil, and the other involving a beef

operation in Argentina.

Management’s Discussion and Analysis