Tyson Foods 2006 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2006 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

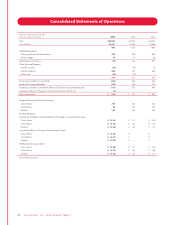

Sales by Segment

Average

Volume Price

in millions 2006 2005 ChangeChangeChange

Chicken $7,928 $8,295 $(367) 3.0% (7.2)%

Beef 11,825 11,618 207 2.6% (0.8)%

Pork 3,060 3,247 (187) 0.5% (6.2)%

Prepared Foods 2,692 2,801 (109) 0.3% (4.2)%

Other 54 53 1 N/A N/A

Total $25,559 $26,014 $(455) 2.3% (3.9)%

Operating Income (Loss) by Segment

Margin Margin

in millions 2006 2005 Change2006 2005

Chicken $53 $582 $(529) 0.7% 7.0%

Beef (296) (12) (284) (2.5)% (0.1)%

Pork 47 47 – 1.5% 1.4%

Prepared Foods 45 78 (33) 1.7% 2.8%

Other 74 50 24 N/A N/A

Total $ (77) $745 $(822) (0.3)% 2.9%

• Chicken segment sales decreased 4.4% and operating results

decreased $529 million in fiscal 2006 compared to fiscal 2005.

Fiscal 2006 operating results include charges of $9 million related

to the Company’s cost reduction initiative, other business consoli-

dation efforts and plant closing costs. Fiscal 2005 operating results

include $12 million of plant closing costs and $8 million of hurricane-

related losses. The decline in sales and operating results primarily

was due to lower average sales prices, predominantly caused by

an oversupply of proteins in the marketplace. Additionally, the

Chicken segment’s operating results were affected negatively by

higher energy costs and decreased margins at the Company’sopera-

tions in Mexico. Fiscal 2006 chicken operating results include

realized and unrealized net gains of $6 million from the Company’s

commodity risk management activities related to grain purchases

compared to realized and unrealized net losses of $27 million

recorded in fiscal 2005.

• Beef segment sales increased 1.8% and operating results decreased

$284 million in fiscal 2006 compared to fiscal 2005. Fiscal 2006

operating results include charges of $52 million related to plant

closing costs, the Company’s cost reduction initiative and other

business consolidation efforts. Fiscal 2005 operating results include

$10 million received in connection with vitamin antitrust litigation.

The operating results decline primarily was due to lower average

sales prices, predominantly caused by an oversupply of proteins in

the marketplace. Additionally, the Beef segment’s operating results

were affected negatively by significant operating margin reductions

at the Company’s Lakeside operation in Canada. Also, fiscal 2006

operating results include realized and unrealized net losses of

$40 million from the Company’s commodity risk management

activities related to its fixed forward boxed beef sales and forward

live cattle purchases, compared to realized and unrealized net

gains of $13 million recorded in fiscal 2005.

• Pork segment sales decreased 5.8% and operating results remained

flat in fiscal 2006 compared to fiscal 2005. Fiscal 2006 operating

results include charges of $2 million related to the Company’s cost

reduction initiative and other business consolidation efforts. Fiscal

2005 operating results include $33 million related to a legal settle-

ment involving the Company’s live swine operations and $2 million

received in connection with vitamin antitrust litigation. Lower aver-

age sales prices, predominantly caused by an oversupply of proteins

in the marketplace adversely affected sales and operating results.

The lower average sales prices were offset partially by lower average

live prices. Additionally, fiscal 2006 operating results include realized

and unrealized net losses of $15 million from the Company’s commod-

ity risk management activities related to its fixed forward boxed

pork sales and forward live hog purchases, compared to realized

and unrealized net losses of $22 million recorded in fiscal 2005.

• Prepared Foods segment sales decreased 3.9% and operating

results decreased $33 million in fiscal 2006 compared to fiscal

2005. Fiscal 2006 operating results include charges of $19 million

related to plant closing costs, other business consolidation efforts

and the Company’s cost reduction initiative. Fiscal 2005 operating

results include $2 million related to plant closing costs. The decline

in sales and operating income primarily was due to lower average

sales prices.

2005 VS. 2004

Certain reclassifications have been made to prior periods to conform

to current presentations.

• Sales decreased $427 million or 1.6%, with a 0.7% increase in

average sales price and a 2.3% decrease in volume. The decrease

in sales primarily was due to reduced sales in the Company’s Beef

segment, resulting from the effects of import and export restric-

tions. Additionally, sales were affected negatively by decreased

sales volumes in each of the Company’s protein segments, pri-

marily due to one less week of sales in fiscal 2005. These declines

were offset partially by higher average sales prices in the Company’s

Chicken, Pork and Prepared Foods segments.

• Cost of Sales decreased $264 million or 1.1%. As a percent of sales,

cost of sales increased from 92.9% to 93.4%. The decrease in cost of

sales primarily was due to decreased grain costs of approximately

$312 million in fiscal 2005 compared to fiscal 2004, partially offset

by higher live costs in the Pork segment, higher raw material costs in

the Prepared Foods segment and higher energy costs. Additionally, the

Chicken segment recorded realized and unrealized losses of $27 mil-

lion in fiscal 2005 resulting from the Company’s commodity risk

management activities related to grain purchases, compared to

Ty s on Foods, Inc. 2006 Annual Report13

Management’s Discussion and Analysiscontinued