Tyson Foods 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

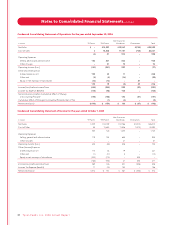

In July 2005, the Company announced its decision to make improve-

ments to one of its Forest, Mississippi, facilities, which included more

product lines, enabling the plant to increase production of processed

and marinated chicken. The improvements were made at the former

Choctaw Maid Farms location, which the Company acquired in fiscal

2003. The Company’s Cleveland Street Forest, Mississippi, poultry

operation ceased operations in March 2006. The Company trans-

ferred the production and employees to the newly upgraded

facilities. The Cleveland Street Forest operation employed approxi-

mately 900 employees. As a result of this decision, the Company

recorded total costs of $9 million for estimated impairment charges

in fiscal 2005. In fiscal 2006, the Company recorded an additional

$2 million for estimated impairment charges. These amounts were

reflected in the Chicken segment’s Operating Income (Loss) and

included in the Consolidated Statements of Operations in Other

charges. No material adjustments to the total accrual are

anticipated at this time.

In July 2005, the Company announced its decision to close its

Bentonville, Arkansas, facility. The Bentonville facility employed

approximately 320 employees and produced raw and partially

fried breaded chicken tenders, fillets, livers and gizzards. The plant

ceased operations in November 2005. The production from this

facility was transferred to the Company’s Russellville, Arkansas,

poultry plant, where an expansion enabled the facility to absorb

the Bentonville facility’s production. As a result of this decision,

the Company recorded total costs of $1 million for estimated

impairment charges and $1 million for employee termination

benefits in fiscal 2005. These amounts were reflected in the

Chicken segment’s Operating Income (Loss) and included in

the Consolidated Statements of Operations in Other charges.

As of September 30, 2006, the employee termination benefits

had been paid. No material adjustments to the total accrual are

anticipated at this time.

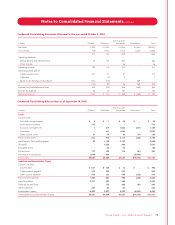

In December 2004, the Company announced its decision to close

its Portland, Maine, facility. The Portland operation employed

approximately 285 employees and produced sliced meats and

cooked roast beef. The plant ceased operations February 4, 2005,

and production from this facility was transferred to other locations.

As a result of the decision, the Company recorded total costs of

$4 million which included $2 million of estimated impairment

charges and $2 million of employee termination benefits. In fiscal

2005, the Company reversed approximately $1 million of closing

related liabilities. In fiscal 2006, the Company reversed approxi-

mately $1 million related to employee termination benefits. These

amounts were reflected in the Prepared Foods segment’s Operating

Income (Loss) and included in the Consolidated Statements of

Operations in Other charges. As of September 30, 2006, the

employee termination benefits had been paid. No material

adjustments to the total accrual are anticipated at this time.

In fiscal 2004, the Company implemented a control whereby all

plant facilities conduct fixed asset inventories on a recurring basis.

As a result, the Company recorded fixed asset write-down charges

of approximately $21 million in fiscal 2004, of which approximately

$13 million was recorded in the Chicken segment, $5 million in the

Prepared Foods segment, $2 million in the Beef segment and $1 mil-

lion in the Pork segment. Additionally, the Company recorded charges

of approximately $25 million related to the impairment of various

intangible assets, of which $22 million was recorded in the Prepared

Foods segment and $3 million was recorded in the Beef segment.

The impairment charges apply primarily to trademarks acquired in

the acquisition of TFM in 2001. These impairment charges were

included in Other charges on the Company’s Consolidated State-

ments of Operations and resulted primarily from lower product

sales under some of the Company’s regional trademarks as prod-

ucts are increasingly being sold under the Tyson trademark.

In fiscal 2004, the Company announced its decision to consolidate

its manufacturing operations in Jackson, Mississippi, into the former

Choctaw Maid Farms Carthage, Mississippi, facility, which the Company

acquired in the fourth quarter of fiscal 2003. The Jackson location

employed approximately 800 employees and was a poultry facility,

including processing and deboning operations. As a result of this

decision, the Company recorded total costs of approximately

$9 million in fiscal 2004 that included approximately $8 million

of estimated impairment charges and $1 million of employee ter-

mination benefits. These amounts were reflected in the Chicken

segment’s Operating Income (Loss) and included in the Consoli-

dated Statements of Operations in Other charges. The Jackson

location ceased operations in August 2004. The Company has

fully paid its estimated termination benefits. No material adjust-

ments to the total accrual are anticipated at this time.

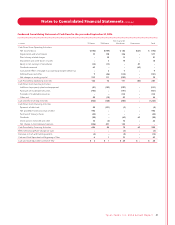

In fiscal 2003, the Company announced its decision to close its

Manchester, New Hampshire, and Augusta, Maine, Prepared Foods

operations to further improve long-term manufacturing efficien-

cies. The production from these facilities was transferred to other

32 Ty s on Foods, Inc. 2006 Annual Report

Notes to Consolidated Financial Statements continued