Tyson Foods 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

available at September 30, 2006, the Company expects an increase

in assets of $6 million, an increase in liabilities of $8 million and

an adjustment to accumulated other comprehensive income of

$2 million when it adopts SFAS No. 158.

In September 2006, the Securities and Exchange Commission

staff published Staff Accounting Bulletin No. 108, “Considering the

Effects of Prior Year Misstatements in Current Year Financial

Statements” (SAB 108). SAB 108 addresses quantifying the financial

statement effects of misstatements, specifically, how the effects

of prior year uncorrected errors must be considered in quantifying

misstatements in the current year financial statements. SAB 108 is

effective for fiscal years ending after November 15, 2006; therefore,

the Company expects to adopt SAB 108 at the end of fiscal 2007.

The Company is currently in the process of evaluating the

potential impact of SAB 108.

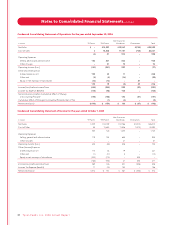

NOTE 2CHANGE IN ACCOUNTING PRINCIPLES

In December 2004, the FASB issued Statement of Financial Account-

ing Standards No. 123R, “Share-Based Payment” (SFAS No. 123R). The

pronouncement requires companies to measure and recognize com-

pensation expense for all share-based payments to employees,

including grants of employee stock options, restricted stock and

performance-based shares, in the financial statements based on the

fair value at the date of the grant. In the first quarter of fiscal 2006,

the Company adopted SFAS No. 123R using the modified prospec-

tive method. Under the modified prospective method, compensa-

tion cost is recognized for all share-based payments granted after

the adoption of SFAS No. 123R and for all awards granted to employees

prior to the adoption date of SFAS No. 123R that were unvested on

the adoption date. Accordingly, no restatements were made to

prior periods.

Prior to the adoption of SFAS No. 123R, the Company applied

Accounting Principles Board Opinion No. 25, “Accounting for Stock

Issued to Employees” in accounting for its employee stock compen-

sation plans. Accordingly, no compensation expense was recog-

nized for its stock option issuances, as stock options are issued

with an exercise price equal to the closing price at the date of

grant. Also, prior to the adoption of SFAS No. 123R, the Company

issued restricted stock and recorded the fair value of such awards

as deferred compensation amortized over the vesting period.

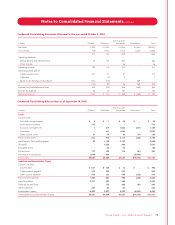

In March 2005, the FASB issued FIN 47, an interpretation of SFAS

No. 143. SFAS No. 143 was issued in June 2001 and requires an entity

to recognize the fair value of a liability for an asset retirement obli-

gation in the period in which it is incurred if a reasonable estimate

of fair value can be made. SFAS No. 143 applies to legal obligations

associated with the retirement of a tangible long-lived asset that

resulted from the acquisition, construction, development and/or

the normal operation of a long-lived asset. The associated asset

costs are capitalized as part of the carrying amount of the long-

lived asset. FIN 47 clarifies the term “conditional asset retirement

obligation” as used in SFAS No. 143, refers to a legal obligation to

perform an asset retirement activity in which the timing and/or

method of settlement are conditional on a future event that may

or may not be within the control of the entity. FIN 47 requires an

entity to recognize a liability for the fair value of a conditional

asset retirement obligation if the fair value of the liability can be

estimated reasonably. Uncertainty about the timing and/or method

of settlement of a conditional asset retirement obligation should

be factored into the measurement of the liability when sufficient

information exists. SFAS No. 143 acknowledges in some cases, suffi-

cient information may not be available to reasonably estimate the

fair value of an asset retirement obligation (ARO).

The Company adopted FIN 47 in the fourth quarter of fiscal 2006.

In connection with the adoption, an ARO liability of $12 million, a

related ARO asset of $3 million and a cumulative adjustment due

to change in accounting principle, net of tax of $5 million were

recorded. The ARO liability is included in Other Liabilities and

the ARO asset is included in Property, Plant and Equipment on

the Consolidated Balance Sheets at September 30, 2006.

The Company’s principal conditional asset retirement obligations

relate to the potential future closure, sale or other disposal of

certain production facilities. In connection with any such activity,

the Company is legally obligated under various federal, state and

local laws to properly retire the related wastewater treatment facility.

The pro forma impact on earnings before cumulative effect of

change in accounting principle, the related earnings per share

amounts and the asset retirement obligation, had FIN 47 been

applied to fiscal 2005 and 2004, were not material.

30 Ty s on Foods, Inc. 2006 Annual Report

Notes to Consolidated Financial Statements continued